Kesari Financial Services (KFS) is a leading Wealth Management organization focused on bridging the gap between Savings & Investments, creating long-term wealth for investors through a range of simple, diversified and relevant investment solutions.

Certified adviser to create your personalized Financial Plan: Your dedicated financial planner will review your current financial situation in a 1-on-1 meeting. Outcome of this meeting is to quantify your financial needs.

OUR STORY

As we are driven by the

passion of touching the lives and not just managing their wealth, and we know

that this would happen only if we are able to disengage our clients from the

arduous task of managing their wealth.

Our vision is to be a responsible player in the Global Wealth Management business, always striving to offer best in class products across Investor’s Life Cycle. We strive hard to deliver consistent performance over the benchmark across all products, thereby creating customer satisfaction. Years of experience offers a broad range of investment products across asset classes with varying risk parameters that cater to needs of various customer segments with different time horizon

Our comprehensive, step-by-step long-term Wealth Creation focused approach ensures that we assist you in planning for all your financial dreams in a focused scientific procedure for both short-term and long-term time horizon keeping cognizance of your risk appetite, time duration and suitable product recommendations.

About The Owner

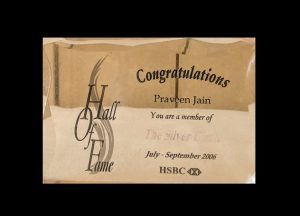

MR Praveen Jain has 20 years of experience in Financial Service Industries. He is certified from IIM-Banglore and hold various Diplomas in Financial Planning & Global Wealth Management. He is registered witht the Association of Mutual Funds of India(AMFI), Insurance Regulatory Development Authority of India(IRDA).

Praveen Jain

Clients need to seek advice from credible advisors. Fiduciaries are the best fit for the clients as they place the client’s interest ahead of every other consideration. This ensures that the client gets the most suitable, aligned advice they can get.

When we started Kesari Financial Services our endeavour was to empower individuals in making smart & informed financial decisions. KFS organises professional workshops for employees of large corporates, Small & Medium Enterprises (SMEs), NGOs, B-Schools & Colleges, Housing societies, professional bodies and individuals.

Kesari Financial Services can help Corporates implement an Employee Financial Wellness Program at the workplace via training/education and coaching/consulting services. These programs cater to needs of employees across all age groups and gender.

SERVICE MATRIX

What Is 5 P's

A financial goal cannot be realised through shortcuts. Based on our industry experience and an individual’s varied needs, we have devised a Customer-Centric Theory that acts as a driving force of Kesari Financial Services. The process enables us to understand, evaluate and then design a suitable financial plan for you. The 5 P’s principle is a real differentiator with the potential of being a game changer.

PASSION

Our penchant for managing finances was the very reason to start our own organisation. We always push ourselves to go beyond the obvious and add value to the offerings. Kesari Financial Services has proved its passion, time and again, through its successful work.

PHILOSOPHY

Our philosophy is clear – to simplify the finances of people by making year wise cash flow.KFS’s financial plan sorts your money and more importantly, your life. We ensure that clients don’t lose sleep over their money. We manage their emotions during the highs and lows and their reactions during crisis. Our expertise in dealing with such situations helps us achieve our objectives.

PRIVACY

Every account is significant for the company. The only people aware of your financial data are us. In this era where information is easily available, we promise to safeguard your confidentiality through our secure data system.

PEACE

As working professionals or businessmen, people are burdened with multiple tasks and have several obligations to fulfill. We take care of the finances by charting a plan that focuses on peace of mind. Managing money is our task but ensuring complete peace of mind is our larger goal.

PROCESS

We are extremely obsessive about our process which is one of our core strengths. Behind our uncomplicated process lies a structured method. Just like an XL T-shirt can’t fit a baby, we don’t offer solutions that are irrational. We study our clients, their goals, and then create a budgeting sheet followed by a detailed tailor-made plan

AWARDS

Back home in India; a research done by Neilson revealed that “80% of working women have no investment say”

At Kesari Financial Services, we provide one of a kind ‘Step up Program’ makes sure that the women from all stages of life gain not just technical knowledge but also find mentoring and emotional support to take charge of their money.

With the changing needs and life style financial planning and wealth management are becoming a very important part of our lives. The financial decisions that we take are very crucial and a deciding factor for our future and dreams.

We all know that there are no free lunches in this world. Hence, the “free advice” you think you are receiving, may not be free at all! It is just that you are not paying directly – that’s all. Unfortunately, most people do not realize that. The entire financial services space operates on commissions based on products sales.

Firstly, we need to understand what is that we want in life. We need to help them think & articulate as to what is that they want in life – what are their goals & objectives. Only then, we would be able to offer a solution that meets their requirements.

Firstly, we need to understand what is that we want in life. We need to help them think & articulate as to what is that they want in life – what are their goals & objectives. Only then, we would be able to offer a solution that meets their requirements.

Kesari Financial Services understands the customers and their priorities very well and hence provides them with the administrative services for all of their banking and financial paper work.

WHOM WE HELP

BUSY PROFESSIONALS

You are an accomplished and busy professional, juggling many different roles and responsibilities. Time is of essence and you seek an advisor who ensures that all matters of finance are taken care of, while you can concentrate on your profession.

ENTREPRENEURS

As an entrepreneur, the lines between work and personal life are blurred and so are the finances. In the quest for making your entrepreneurial venture a success, almost everything except the entrepreneurial venture takes a back seat.

NON RESIDENT INDIANS

Non-resident Indians today are in a confluence of cultures. Whether you are a UAE based NRI or a USA based NRI, you are trying to ensure you get the best of both worlds. This means the best lifestyle, best education, best healthcare etc,

PEOPLE IN TRANSISTION

Life throws many challenges at you, which make you go through life transitions. These transitions could be pleasant such as a child qualifying for college education at a top notch university, or a promotion accompanied by geographical movement.

PEOPLE ON THE GO

As a Pilot, Master Mariner or a Seafarer you are usually on the go due to the demands of your profession. There are times when you are away from home for days or months at end and then some days are easy.

WOMEN

Women all over the world, have traditionally been shielded from money and finance. Most women in India have usually been told that money is a man’s domain. Consequently, when situations related to manage money arise, women find themselves unprepared for the role