need to do. This is fully justified and much needed as there is a large population of adults who are yet to plan for their retirement. However, there is not much being written about the decisions that you need to take the after and during your retirement. The time is finally approaching, you are 59.5 years old, and have a big corpus expected to arrive soon. All your goals must have been achieved by now, and the only major goal left would be to maintain your lifestyle after retirement. You have been dreaming throughout your life about how this golden period would be, and how you’ll travel all the places which are left unchecked on your list with your spouse. Along with these questions, there are more pressing ones like … what will I do with the money? How should I start deploying my funds? that keeps ringing in your mind. In this article, we shall talk about a few of these important decisions that you need to make post retirement but before that let us do a reality check on the retirement scenario present in India…

Reality Check

As per the WHO’s World Statistics Report 2016, the life expectancy at birth was 68.3 years in India which breaks down to 66.9 years for men and 69.9 for women in year 2015. The life expectancy at various ages

has been continuously increasing owing to better medical facilities. Life expectancy at 60 was 17.9 years between 2009 and 2013 compared to 16.2 years between 1991 and 1995. Life expectancy at 60 was always more for female and male with the difference being of nearly 2.5 years.

However this is a global figure for all Indians, urban and educated population in India have significantly higher life expectancies. some advanced states like Kerala have life expectancy over 75 years. Another eye opening stats shared by HSBC recently is that data nearly 47% of ‘working’ people in India have either not

started saving for their retirement or have stopped or faced difficulties while saving. Clearly, we are expected to live longer than the figures presented here which means that we would likely have over 20 years of post retirement life.

Asset Allocation

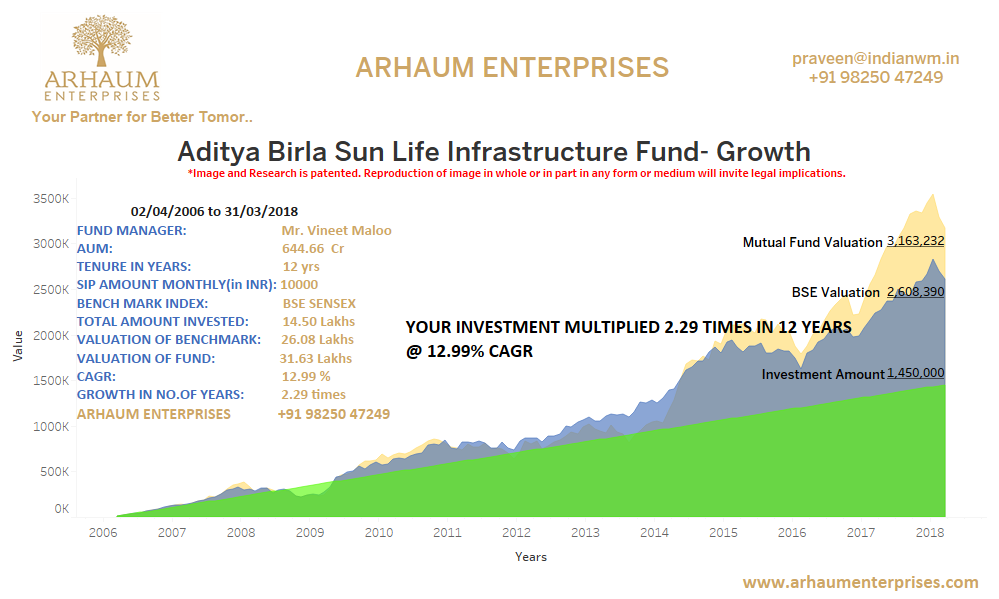

An important decision before investing is the amount of kitty you have and the asset allocation needed which will sustain your kitty till you need it during your retirement. Most people prefer not to risk their money

at all and divert their entire retirement corpus to traditional debt products, such as fixed deposits or bonds or insurance policies. These schemes do offer protection of principal but yield low returns. Since the returns will not be able to catch up with inflation, you might fall short of funds in future. Instead, debt mutual fund schemes do offer better post tax returns at acceptable levels of risks for you.

In a falling interest rate scenario like India, debt funds are considered as good investment option even for long term. Further, if your retirement kitty itself is small which may not last long, then there must be some planning on growing that kitty. This can be possible with a small portion of your kitty, say up to 20% being invested in equities for long term (over 5 years at least) where 80% of the kitty is for risk-free consumption during that time. You may further reduce this risk by investing slowly through Systematic Transfer Plan (STP)

from a debt to equity scheme.

Regular flow of Income

Since there would be no new money coming in, you should go for lump sum investments with regular return options like Systematic Withdrawal Plan (SWP) or dividend option schemes of mutual funds for meeting for your monthly expenses. You may also be receiving rental incomes or you you may deposit a lump sum in

fixed deposits or bonds to yield interest income. Those who do not have adequate kitty or regular flow of money may be forced to pursue some commercial activities post retirement, which is not a bad choice even if you have a adequate kitty with you. Working, for money or otherwise, after retirement can help you be more active and alert and this will help you socially, economically and physically too…

Health Coverage

Medical expenses will shoot up like never before in your retirement period and you may never anticipate what will hit you and when. The best idea is to get adequate health insurance coverage as soon as possible. Ask your children to cover you and your spouse in their personal family floater health policies. Most big organisations also provide parents health coverage at nominal costs – ask your children to enrol for the same at earliest. It can be a big relief for you and your children when any need arises. An important point to note is never to discontinue any running health policy you have, unless required. Buying a new policy at this age can be costly and you will have limited choices to choose from.Other important decisions…

Contingency funds

Apart from your regular expenses, emergencies can pop up from anywhere and anytime. You must be able to meet those contingencies and be prepared for them with the help of an emergency fund. This fund should be liquid enough to be able to serve the purpose and in such arrangement, if possible, that it can be accessible by your family too.

Estate Planning

If you have not done it yet, you must do it at the earliest. It is better to hire a professional or a reputed service provider to make your will. However, will is only one instrument of estate planning and you may like to set up private trusts, have business succession planning done, make gift arrangements, etc. Appointing of appropriate nominees and joint holders for your assets is also important at this stage. As far as a will document is concerned, it is the basic need to ensure that your assets are transferred in the manner you like instead of the law taking its course. Ensure that you have done all necessary pre-planning and discussions

for same to avoid any family disputes that may arise later.

Managing investments

Keep it simple:

Don’t try to complicate your portfolio by including products which you do not understand. Invest in something only after you have acquired adequate knowledge about its functioning, return generating capabilities, risks involved, etc. If it is difficult to comprehend, you might as well omit it than keeping the possibility of facing difficult circumstances later. Don’t lock in: Retirees often put a huge lump sum in annuity schemes offered by insurance companies or some other pension / small savings schemes in lieu of regular cash flow throughout your life or for certain number of years. It offers certain benefits like regular income, it covers longevity risk, and reinvestment risk. On the flip side, these investments are illiquid, offer lower returns and the returns are taxable. So you should consider these pros and cons before investing in such pension plans, and allocate a appropriate portion of your portfolio to the same.

Tax Awareness:

The returns of most investments are taxable and tax may be deducted at source. If you are not falling

under a tax bracket, you should take care that you are not paying taxes. For e.g. interest on bank deposits is taxable if it exceeds R10,000 in a particular year. So you should make sure that you submit form 15H in time, so that your interest is tax free. You should also consider the tax impact of various investment products before investing.