We have all made mistakes in past and most likely would also make mistakes in future. Making mistakes is not crime but is something human in nature.However, we must learn from past mistakes and failure to do so is most undesirable. When it comes to personal finance decisions, the best way of learning is by analysing the opportunity cost for our bad decisions.

Opportunity Cost:

But before we start, let us first understand what is ‘opportunity cost’. The opportunity cost can be understood as

- the cost of doing any action measured in value terms of the best alternative that is not chosen or is foregone.

- a sacrifice value of the second best choice available to someone who has picked among multiple choices

Opportunity cost is a key concept in economics, and is used in decision making where there are scare resources to be optimally utilised. The concept can be applied beyond financial costs: you may apply it for lost time, pleasure or any other resource that provides some benefit. Thus, opportunity cost can not only help us in evaluating investment decisions but also can be universally applied to any decision that we take.

Analysing Wrong Decisions:

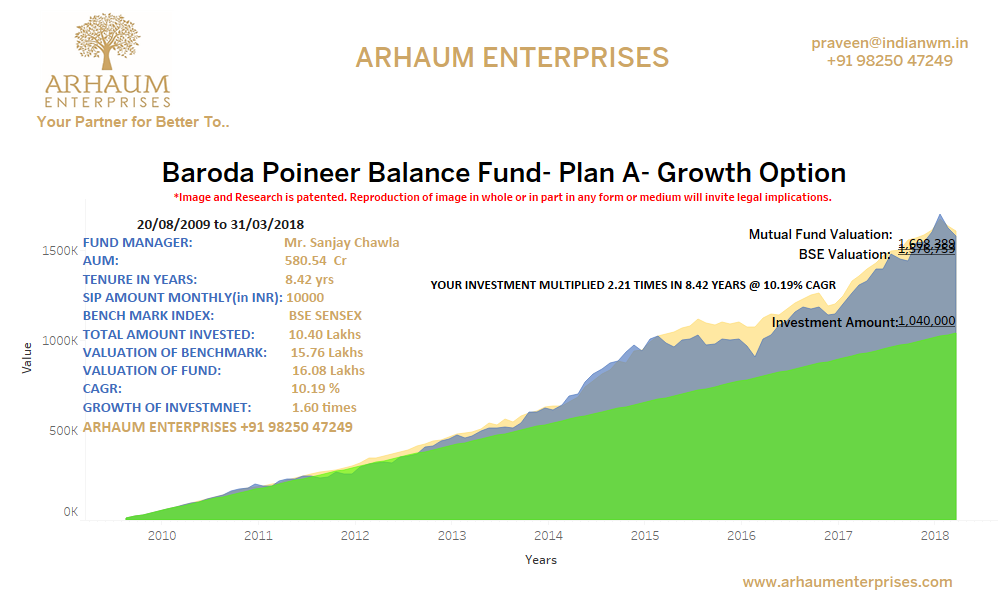

Let us now attempt to analyse our decision using opportunity cost and a few case studies. The case studies are random examples of what most of us usually are or have ended up doing in past.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Above is for illustrative purpose only. Assumptions: MF Equity returns: 15%. Debt returns: 10%. MF Cash: 7%. Inflation 6%. Post Retirement Inflation 4%. Returns on Kitty: 8%. Some figures are rounded off.

Including the above instances, we can short-list the following very common types of action / inaction that have lost opportunity costs attached to it…

- Planning for financial goals: Here the opportunity cost is often in nature of inability to meet the targeted value fully if we either delay savings for goal or invest in wrong asset class.

- Retirement planning: This is highlighted here since it has huge impact involved which are not very apparent to us and is often ignored. There can be huge opportunity costs in terms of the required savings to be done and the retirement kitty created if we delay or invest in wrong asset class. The biggest risk is that the kitty becomes insufficient to meet our expenses during retirement.

- Ignoring Insurance: Ignoring, delaying or taking inadequate insurance is very common. Lack or inadequate life insurance is something very scary since the idea of our loved ones left without any money in itself is unimaginable. Still most of us take inadequate cover without finding out actual cover required and instead directly start looking at products. The opportunity cost in absence of medical insurance is something which would now be very obvious.

- Idle money not invested: Due to financial indiscipline, we often ignore investing less substantial money on time in appropriate avenues and money is often left idle in form of hard cash or current / savings account balance. We must invest idle money, beyond that required for emergency, running expenses, etc., into liquid MF or similar schemes / products for the small durations of time available. A regular practice of doing so actively can help you good returns on idle money which is not visible to us now.

- Common investment related bad decisions.: If we can summarise, there would largely be 3 types of bad decisions w.r.t. investments:

- Investing in wrong asset class as per investment horizon

- Delay in starting investments or SIP

- Investing inadequate amount

- Other bad decisions: Apart from above we also have many other common instances of bad decisions like…

- Investing in ‘Ponzi’, ‘Get Rich Quick’ or ‘Chain Marketing’ schemes with hopes of making huge money!

- Taking personal loans for avoidable reasons

- Making cash withdrawals from credit cards

- Not paying credit card dues on time inviting very high interest costs

- Making delayed payments of utility bills, etc. attracting additional money for every instance

The famous and the most successful investor – Warren Buffet has said that “you only have to do a very few things right in your life so long as you don’t do too many things wrong” to be successful. Indeed, many small things ignored add up and become significant enough to impact our lives. And bad investment / financial decisions are no different.

The following are the suggested ways that will help us go a long way in improving our financial situation over long term.

- Always remember that every financial action or inaction has some opportunity costs

- Procrastination or laziness is a big enemy for wealth creation

- Small things make big impact over time. Discipline, awareness and active decision making are the right habits to adopt

- Prepare comprehensive financial plan at the earliest. Do not shy away from seeking advice on small financial matters.

The idea behind this article is to make you aware that every financial decision has costs attached to it and that proper planning, discipline and timely action in our financial matters can help us ensure that we keep the wrong things to the minimum in our lives. A few wrong things are enough to overshadow the benefits from many rights things that we may have taken.