As an early 30’s person, you must be recently married with or without a kid, or about to be married. Your parents and family is dependent on you and you have a whole list of targets which you want to achieve in life. You must be in the middle stage of your professional life and looking forward to own a house and a car or upgrade the existing in the near future.

Most people at this time take impulsive decisions and pay for them for the rest of their life. Some common mistakes that people in their early 30’s tend to make are:

- People are mostly under insured. Most corporate employees rely on the corporate medical insurance.

- Early 30’s is an age where we don’t want to compromise on our lifestyle. People end up buying big luxury flats, which is something they don’t require or afford at this age.

- Our tax saving is not properly planned. Usually we end up buying random traditional tax saving schemes at the end of the year.

- People may be modern in other things, but when it comes to investments; they will follow their parents and stick to conventional instruments of investments. Some might try their hands in the equity market, but with improper knowledge and guidance, they spoil everything and then return to conventional instruments.

- Investments are not aligned to goals. People invest randomly without calculating if they are sufficient to meet their goals or will that investment mature when needed.

- People think that it is too early to plan for retirement and they have the whole life to earn and save for retirement.

- People don’t plan for emergencies. And many of them rely on investments / assets to meet these expenses when such emergencies arise.

You you need to polish your financial skills and plan your life as a financially intelligent person so that you can be financially much better later on. The idea is, not committing the silly mistakes, which an average Indian of your age would be making, and be smart in managing your finances.

Let’s analyze our position and see if we are on the right track and if not, change the details where are going off track

Insurance:

- Medical: The insurance provided by the company usually does not include family, secondly the cover is small, and thirdly it will be gone in case of a job change. So, an individual would need another medical insurance for himself and his family. He can go for a family floater including his parents, wife and kids. The amount of the cover should be set keeping in mind the high medical costs plus the age of your parents. Another option is to buy a family floater with a relatively small protection and smaller premium and get a separate policy for your parents.

- Life: Most people view insurance as an investment and have traditional life endowment plans, but the premiums of these policies are very high and a corpus is created providing nominal returns. These plans however, do not serve the purpose, since the protection is not enough to take care of the family in case of any mishap. It would be best to go for a pure protection plans with big covers, which should be enough to support your family. The monthly premium would also be significantly lower for such policies taken at a younger age.

- Personal Accident: Most life and the health policies are structured such that they are useless if you meet any accident. Any permanent or temporary disability and hospitalization due to accident can ruin a bright future for you and your family. A comprehensive personal accident cover for a large sum is most adviced at this age where you are a bit more accident prone.

Car:

If you already have a car, the sale proceeds of this car can be used as a down payment for the next in line upgrade, and if you do not have one and can afford one, you have to arrange for the down payment from your existing savings or future bonus or may be start an SIP for this purpose. With professional growth and salary hikes, you would be able to manage the increased installments. If you have a decently working car without EMIs, we strongly suggest to continue with the car for couple of years more and instead make additional savings (in lieu of car loan EMI) during the period. This will help you save more for higher down payment and/or a better car.

Emergencies:

It is recommended that you save around 3 to 6 months of monthly cash inflow /income as emergency funds. This does not mean that you need to keep cash at home; the idea is to keep money in reasonably liquid investment avenues like liquid /debt mutual fund schemes. Emergency funds are needed for those long gaps between job change or any unexpected event might lead to need for money to meet the family’s daily expenses.

House:

There is often a debate on whether you should buy or rent a home and it is often pointed out renting is better. But buying a home is often more driven by emotions and social pressures than pure finance. If is also better to delay the buying decision for home and start saving aggressively for same with a target of say buying home at age 40. By then you will have adequate wealth already created to buy a decent home and without too much of financial burden.

If you have decided on buying a home, firstly analyze your requirement according to your income and family members. Don’t aim for a house which is too big to fit in your pocket as you can always trade the one you have for a bigger one later in life. Always take a life cover / insurance with you home loan to not burden your family in case any eventuality happens.

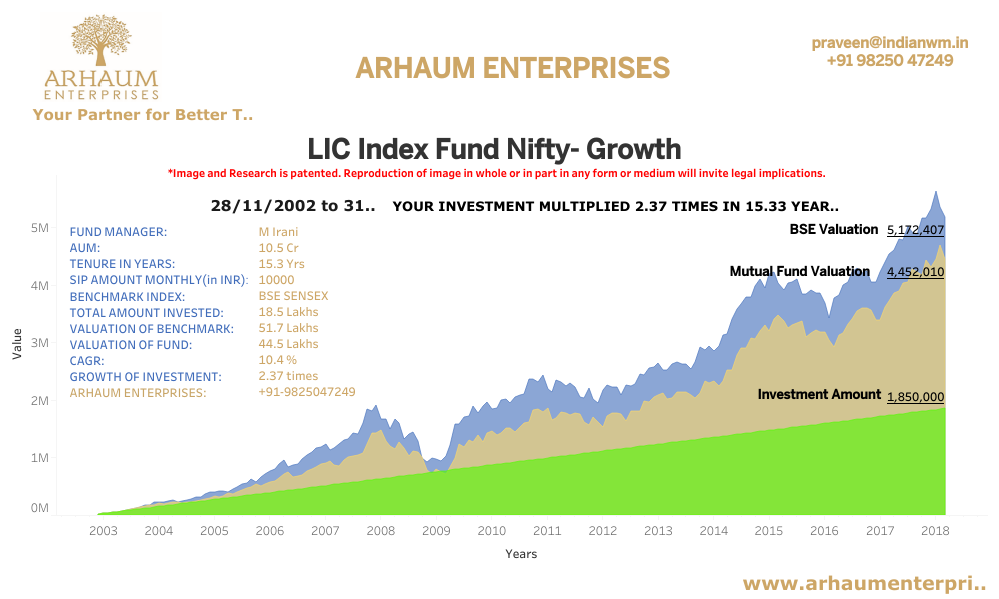

Retirement: If you are in a private job, you won’t get any pension. You might have EPF and PPF, but these have lower interest rates which will mostly be offset by inflation. So, in order have a huge corpus at the time of retirement to maintain your lifestyle, you should change your strategy and divert the money towards equity, as amount invested in equity over a long term can yield returns higher than any other mode of investment. You may start an SIP and continue with the EPF and PPF, but with the minimum required amount. These will provide for your annual tax saving investments plus will serve as an investment for retirement too.

Putting some money towards retirement at this age is highly recommended since time is your friend for a comfortable retirement. With the power of compounding in equities over say 2-3 decades, your wealth can be substantially boosted which can never be made up even with much higher savings later.