Franklin Asian Equity Fund

Franklin Asian Equity Fund

Franklin Asian Equity Fund is a diversified equity fund that seeks long-term capital appreciation by investing in Indian and other Asian companies (excluding Japan) across sectors and market capitalization range. Exposure to domestic companies is restricted to a maximum of 40% of the portfolio. Provides exposure to companies that benefit from rapid growth in the Asia region excluding Japan.

Templeton India Equity Income Fund

Templeton India Equity Income Fund

Templeton India Equity Income Fund invests in Indian and overseas companies that have the potential to provide growth through capital appreciation as well as regular income through dividends. The ideal investment horizon for this equity fund is 5 years or more. The dividends from Templeton India equity funds are tax-free.

Types Of Equity Funds Part 1(English)

Types Of Equity Funds Part 1(English)

The fund manager can identify the hidden value in a company that others may have missed, and begin buying this stock. When the others realize the value of the company, they start buying too and the stock prices appreciate, making a person’s investment appreciate it! The ‘Growth Style’ investing follows the logic of investing in companies that are likely to continue growing their profits at a reasonable rate.These aren’t all! There are other ways, in which equity funds can be classified, each with unique characteristics, making it easy for investors to find one that suits their needs”

Types Of Equity Funds Part 2(English)

Types Of Equity Funds Part 2(English)

The video also talks about what is diversified equity mutual funds, and how they make it easy to invest your money in diversified assets. Let’s say you’re free to go ahead pick a diverse range of different fruits, from different trees of different qualities from a garden, at the price of a regular fruit basket. The answer is that they further this principle, a diversified equity fund spreads its portfolio across a mixed basket of stocks.A lot of people, like you, only like apples, making apples quite popular and in demand.

Types Of Equity Funds Part 3(English)

Types Of Equity Funds Part 3(English)

This video classifies the mutual funds according to their market capitalization. Learn what is a large-cap mutual fund, mid-cap fund, small-cap mutual fund, and a multi-cap fund. Also learn about balanced funds, which will give you growth as well as stability. Mutual Funds can also be classified based on the size of the underlying companies in the portfolio. Some of these classifications are Large Cap Funds, Mid Cap Funds, Small Cap Funds, and Multicap or Flexicap Funds, where ‘cap’ is short for ‘capitalization’ or ‘market capitalization.

A look at Private Equity Investments in the Indian Market

A look at Private Equity Investments in the Indian Market

Financial Opportunities Forum (February 2018): Mr Rajeev Thakkar takes a look at how Private Equity businesses have shaped the business & investment climate in the Indian context. Private Equity investors have been involved in the Indian capital markets for a while now. They not only affect operational performance at many of their invested companies but also affect the market valuations by providing growth capital at the right time for businesses to scale.

Investment Philosophy Equity

Investment Philosophy Equity

Equity as an asset class helps beat inflation and in fact over long periods of time is being one of the best performing asset classes. When investors look to invest in equity, we believe that a large part of that allocation should go into a low-risk product. A product which allows them to sleep easy and helps them to participate in the growth of the companies in the market.

What are equity stocks or shares and how are they different from bonds

What are equity stocks or shares and how are they different from bonds

Stocks and bonds represent two different ways for an entity to raise money to fund or expand their operations. When a company issues stock, it is selling a piece of itself in exchange for cash. Since each share of stock represents an ownership stake in a company – meaning the owner shares in the profits and losses of the company – someone who invests in the stock can benefit if the company performs very well and its value increases over time.

Edelweiss Equity Savings Advantage Fund Radhika Gupta, CEO, Edelweiss Asset Management Limited

Edelweiss Equity Savings Advantage Fund Radhika Gupta, CEO, Edelweiss Asset Management Limited

Edelweiss Equity Savings Advantage Fund endeavours to provides a blend of Safety, Growth and Income.

Edelweiss Dynamic Equity Advantage Fund Navigates smoothly between market ups and downs

Edelweiss Dynamic Equity Advantage Fund Navigates smoothly between market ups and downs

Edelweiss Dynamic Equity Advantage Fund -An open ended equity scheme which navigates smoothly between market ups and downs. Aims to create wealth with lower volatility and downside protection.

Edelweiss Dynamic Equity Advantage Fund Radhika Gupta, CEO, Edelweiss Asset Management Limited

Edelweiss Dynamic Equity Advantage Fund Radhika Gupta, CEO, Edelweiss Asset Management Limited

Edelweiss Equity Savings Advantage Fund endeavours to provides a blend of Safety, Growth and Income.

Mutual Fund Review DSP Blackrock Small & Mid Cap Fund Top Mid Cap Equity Funds 2017

Mutual Fund Review DSP Blackrock Small & Mid Cap Fund Top Mid Cap Equity Funds 2017

DSP Blackrock Small & Mid Cap Fund is a Small/Mid Cap focused Fund in the category. It is an high risk fund with inconsistent performance in last 10 years. It has given some exceptional performances too. Fund is managed by new fund manager popular fund manager Vinit Sambre who joined them in 2012 . For detail review, please watch the video.

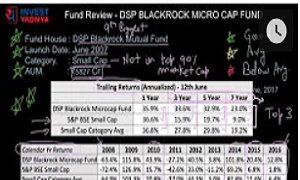

Mutual Fund Review DSP Blackrock MicroCap Fund Top Small Cap Funds 2017

Mutual Fund Review DSP Blackrock MicroCap Fund Top Small Cap Funds 2017

DSP Blackrock MicroCap fund is a Small cap focused mutual fund which invests in companies beyond top 300 by market cap in India – it is one of the best mutual funds for 2017. It is the largest Small cap fund as per Value Research Classification. Currently, it has no allocation to large caps. It has given very good performance in last 10 years. It is managed by Vinit Sambre who is managing this fund since 2010. For detail review, please watch the video.

Mutual Fund Review DSP BLACK ROCK TAX SAVER FUND Good or Bad Large Cap Equity Fund 2018

Mutual Fund Review DSP BLACK ROCK TAX SAVER FUND Good or Bad Large Cap Equity Fund 2018

This Video is very helpful for conservative investors who is looking forward for tax saving so please watch full video before investing in it.

Equity scheme with downside protection

Equity scheme with downside protection

Introducing DSP BlackRock A.C.E. Fund (Analyst’s Conviction Equalized) Series 1. Get the power of protection, process & discipline and A.C.E at every phase.

DSP BLACK ROCK EQUITY FUND

DSP BLACK ROCK EQUITY FUND

An Open Ended growth Scheme, seeking to generate long term capital appreciation, from a portfolio that is substantially constituted of equity securities and equity related securities of issuers domiciled in India

Insights on L&T Dynamic Equity Fund

Insights on L&T Dynamic Equity Fund

Watch Soumendra Nath Lahiri, CIO – L&T Investment Management Limited, speak about the features and highlights of L&T Dynamic Equity Fund.

Is it right time to invest in Equity

Is it right time to invest in Equity

Get the correct answer to this perennial question that everyone has on their minds

Why have you not invested in equity mutual funds

Why have you not invested in equity mutual funds

This video busts all the myths associated with investing in equity mutual funds.

How long you should stay invested in equity mutual funds?

How long you should stay invested in equity mutual funds?

Not everyone is able to leverage their investment in equity asset class. This video busts the myths and highlights the benefits of staying invested for a long period in equity mutual funds.

Are there any tax benefits in Equity oriented Balanced Funds #AllAboutMF

Are there any tax benefits in Equity oriented Balanced Funds #AllAboutMF

This video is a dialogue/informative on the benefits of Equity in Balanced funds.

Edelweiss Dynamic Equity Advantage Fund Navigates smoothly between market ups and downs

Edelweiss Dynamic Equity Advantage Fund Navigates smoothly between market ups and downs

Edelweiss Dynamic Equity Advantage Fund -An open ended equity scheme which navigates smoothly between market ups and downs. Aims to create wealth with lower volatility and downside protection.

Investors guide DSP Equity

Investors guide DSP Equity

In this video, the tips/advises is given to investors on DSP Equity Fund

Kotak Emerging Equity Fund

Kotak Emerging Equity Fund

Kotak Mutual Fund presents Pankaj Tibrewal, Fund Manager (Equity). He throws light upon how equity fund is for investors looking for extra returns. From out performance v/s bench marking, risk – return ration, portfolio composition, sectoral outlook to financial savings v/s physical saving, he covers it all.

Kotak Tax Saver Equity Fund

Kotak Tax Saver Equity Fund

Kotak Tax Saver is an open-ended equity linked saving scheme. The investment objective of the scheme is to generate long-term capital appreciation from a diversified portfolio of equity and equity-related securities and enable investors to avail the income tax rebate, as permitted from time to time.

What should investors look at while investing in a diversified equity fund?

What should investors look at while investing in a diversified equity fund?

Mr. Nilesh Shetty, Associate Fund Manager – Equity, Quantum AMC gives his views on what should investors look at while investing in a diversified equity fund.

Apka Tax Apke Naam Equity-linked Savings

Apka Tax Apke Naam Equity-linked Savings

You like to keep your things to yourself. Now you can Keep your Income Tax in your Name too with Equity Linked Savings Scheme (ELSS) #AapKaTaxAapKeNaam.

Types and Benefits of Equity Mutual Funds

Types and Benefits of Equity Mutual Funds

Curious about what is equity mutual fund? Watch the video to find out about the different types of equity mutual funds, and the types of equity mutual funds based on the types of investing. Learn what is value investing based mutual fund and what is a growth investing based mutual fund to decide which type of mutual fund you would like to invest in. Equities is a subject that’s of great interest amongst investors the world

Are there any tax benefits in Equity oriented Balanced Funds #AllAboutMF

Are there any tax benefits in Equity oriented Balanced Funds #AllAboutMF

Early start in Equity Mutual Funds

Early start in Equity Mutual Funds

Megha, a millennial, has the ambition to be her own boss and take charge of her financial journey at a young age. Listen to her story!

Moving from Real Estate to Debt and Equity Mutual Funds She Invests SBI MF

Moving from Real Estate to Debt and Equity Mutual Funds She Invests SBI MF

This video represents a financial journey of Supriya who choose to invest regularly in mutual funds like equity funds and debt funds instead of overexposing herself to investments in real estate with the intention to earn a regular source of income. Supriya is an independent working professional who after seeking advice from her friend (a financial advisor) decided to invest in mutual fund investment options like debt mutual funds and equity mutual funds so as to create a corpus along with a passive source of income.

#MutualFund101 – Episode 3 – What are Equity Funds English

#MutualFund101 – Episode 3 – What are Equity Funds English

Equity funds offer long-term growth, appreciation and lowered risks among several other advantages over simple Equity.

Benefits of investing in Equity, Debt and Liquid Instruments

Benefits of investing in Equity, Debt and Liquid Instruments

This video educates the benefits of investing in different financial instruments – equity, debt and liquid.

Invesco India Dynamic Equity Fund YouTube

Invesco India Dynamic Equity Fund YouTube

Invesco equity fund is a large cap fund that is one of the best in this category. This video gives a snapshot of this fund and who all should invest this.

All About Equity & Debt Market Prof Simply Simple & Suppandi

All About Equity & Debt Market Prof Simply Simple & Suppandi

TATA Mutual Fund presents Prof Simply Simple, a wealth advisor that explains concepts in simple language. In this video he is explaining the differences in equity and debt markets and thier respective benefits.

What is Axis Dynamic Equity Fund and how does the dynamic equity allocation model work?

What is Axis Dynamic Equity Fund and how does the dynamic equity allocation model work?

This video explains the Dynamic Equity Fund offered by Axis Bank and explains how the dynamic equity allocation model work in English.

Do you know what equity mutual funds are?

Do you know what equity mutual funds are?

This video explains what equity mutual fund is.

How much money is required to invest in equity mutual funds?

How much money is required to invest in equity mutual funds?

One can start with even an investment of Rs. 500 in equity mutual funds. Here is an easy way to understand the minimum amount required to invest in an equity mutual fund.

SBI Magnum Equity Fund Equity Mutual Fund SBI Mutual Fund

SBI Magnum Equity Fund Equity Mutual Fund SBI Mutual Fund

Equity funds offer long-term growth, appreciation and lowered risks among several other advantages over simple Equity.

SBI Magnum Multicap Fund Equity Scheme SBI Mutual Fund

SBI Magnum Multicap Fund Equity Scheme SBI Mutual Fund

To provide investors with opportunities for long-term growth in capital along with the liquidity of an open ended scheme through an active management of investments in a diversified basket of equity stocks spanning the entire market capitalization spectrum and in debt and money market instruments.

SBI Magnum Global Fund Equity Mutual Fund SBI Mutual Fund

SBI Magnum Global Fund Equity Mutual Fund SBI Mutual Fund

SBI MAgnum Global fund seeks to provide the investor with the opportunity of long term capital appreciation by investing in diversified portfolio comprising primarily of MNC companies

SBI Equity Savings Fund Open Ended Equity Scheme SBI Mutual Fund

SBI Equity Savings Fund Open Ended Equity Scheme SBI Mutual Fund

SBI Equity Savings Fund -An open ended equity scheme which navigates smoothly between market ups and downs. Aims to create wealth with lower volatility and downside protection

What are Equity Funds?

What are Equity Funds?

Equity funds are those that invest primarily in ‘equity shares or stocks, which are also collectively known as equities’. There are different types of equity mutual funds which are Large cap fund, Mid cap fund, Small cap fund, Diversified Equity Funds, Sectoral funds.

Mutual Fund Review L & T Emerging Business Fund Should You Invest Small Cap Equity Fund 2018

Mutual Fund Review L & T Emerging Business Fund Should You Invest Small Cap Equity Fund 2018

Video tells about L&T Emerging Business Fund and its comparison with other funds and which are the top 5 best sectoral funds among them,

Kotak Emerging Equity Mutual Fund

Kotak Emerging Equity Mutual Fund

Kotak Mutual Fund presents Pankaj Tibrewal, Fund Manager (Equity). He throws light upon how equity fund is for investors looking for extra returns. From out performance v/s bench marking, risk – return ration, portfolio composition, sectoral outlook to financial savings v/s physical saving, he covers it all.

Peerless Mutual Fund Equity Philosophy & Process

Peerless Mutual Fund Equity Philosophy & Process

Experts tell us about the Peerless Mutual Fund Equity- how it creates value for investors by sharing his views on it