This was during the year 2009 – 2010. Mr. Shankar, Amit’s father retired few weeks back and he was enjoying his retired life. After retirement he got a hefty sum from his savings as PPF & Gratuity. One day, Amit & his father, Shankar was having a conversation –

Amit – Dad, I am very happy to see you enjoying your retired life. But I wonder if you could tell me about your savings. What have you done with it?

Shankar – Hey Champ, I have kept this money in three different banks as Fixed Deposit for 3 years. I would be getting average 10% interest per annum which would suffice mine and your mother’s expenses.

Amit – Ohh.. that’s great.. Good plan Dad..

As per plan, every month’s income was sufficient though the bank was deducting the Tax (TDS) on the interest offered. But Shankar was comfortable as this amount was enough to fulfil the monthly expenses. Days, weeks, months and years passed and in the year 2013, Shankar received a call from the bank. The banker told him that the Fixed Deposit that he has made would be matured next week. He also requested Mr. Shankar to come to a bank and renew the instrument. Shankar immediately visited bank where he learnt two things –

- Due to every month withdrawal, his base amount has not appreciated. It was the same amount which he had invested.

- Earlier the interest rate was 10 % but now the interest rate would be 9.00%

Shankar was bit worried when he understood that the amount that he will be getting every month will be less than the amount which he was getting earlier. But he had no option as he was not ready to take risk on the only savings that he had. So he decided to renew the Fixed Deposit for another 5 years. That day evening, while having dinner, he shared this with Amit –

Shankar – Amit, I visited a bank to renew my Fixed Deposits.

Amit – So, What happened?

Shankar – But I am nervous as the interest rates have gone down. I will be getting only 9% interest on my investment. This amount will be on the border line of my requirements. So at times you may will have to support me financially.

Amit – Don’t worry Dad… Surely..

Now Shankar had to spend money very carefully as the income from interest on FD was as same as to his expenses. Days.. weeks.. months.. Time was flying at its own pace…. And the day came (2016) when Shankar received another call from the Bank to renew his FD. But this time the interest rate was only 7.75 %. This was a very bad news for Shankar. Now he had no option but either to depend on his son for few of his day to day life expenses or work somewhere again. For whole of his life he worked very hard but that didn’t help him to live happy retired life.

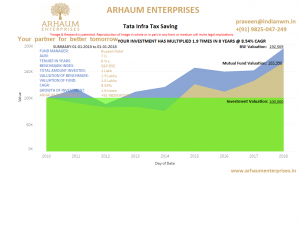

Dear Friend, The jist of the story is, FD interest rates are coming down and on the other hand inflation is rising. If we keep our money in FD, then after few years, value of our money will depreciate and the gap between our expenses and our income will be widened.

If we wish to secure our retired life, we have one solution and i.e. “BALANCE FUND”. Now if we compare FD and Balance Fund, surely there is a minimal risk in Balance Fund but we look at the average returns for the last few years, this risk is nullified. If we keep our money in FD and use interest for expenses, our Capital does not appreciate, but if we invest the same amount in Balance Fund and if we opt for SWP (Systematic Withdrawal Plan), then we get fix monthly income as well as our capital also appreciate over a period of time. This happens because some portion of your fund is invested in Equity Markets and some portion in Debt Market. Another advantage of investing in Balance fund is the monthly income which I get is totally Tax Free. All Mutual Fund AMCs have various Balance Fund schemes. So you need to consult an experienced financial advisor to select a right balance fund from the exhaustive list of schemes. You need to change the mindset as per time and situation. Think Different and be Smart.