Date : 05 May 2017

Young adults are perhaps the richest among all of us. They have something more – “time”, an age when the possibilities are unlimited. In case you are a young adult in 20s or 30s or a parent / guardian with children approaching or are in their 20s, this article is for you. The article guides us to do a few things which perhaps no one has ever told us to do. These things will introduce you to the world of finance and when taken, will be your first steps to the world of finance…

Why Take These Steps?

There is one common thing which most people after the age of 35 regret. That common regret is about not knowing about investments and saving at a young age. To be financially successful, being skilled and knowledgeable is not enough. You need to have the right wealth management skills to be rich. It can amplify or magnify your income many times over. Hence, while you should focus on learning and pursuing your career dreams, you should also focus on increasing your ‘wealth quotient’. The earlier you take the jump, the chances of becoming wealthier soon, increases. Being in your teens or in your 20’s is the best time to take the steps listed here…

The First Steps:

1. Learn about Personal Finance & Investing

Knowledge about personal finance topics and investing at an early age is a great asset. Young adults must know about different asset classes, investment products, insurance, loans & credit, time value of money, inflation, savings, taxation, financial planning, etc. Such knowledge, especially during early years of career can really help someone take great decisions for future. If you are a guardian, be sure to involve the young adults in your own investment decisions. There are many ways in which young adults can gain financial knowledge. Some of them are…

- Read books, finance magazines and watch TV shows on investments

- Interact with financial advisors, accountants, experienced family members

- Attend investment seminars/camps by regulators, participants in financial services industry

- Enroll for any certification from the many offered by NSE/BSE on the subject matter

2. Get Engaged:

Your parents must already be investing and interacting with their accountants and financial advisors. We encourage you too to participate in learning and understanding the decisions, your parents are making. You may ask them about what financial savings are being done for your future. You may also enquire about insurance coverages, etc. taken for all family members and whether those are accurate. As savvy internet users, you may also share your feedback and suggestions to your parents in their wealth management activities. We are confident that with the kind of access to information you have, you can surely start adding great value to family financial matters.

3. Control your spendings

Young adults are perhaps the most valued consumers hunted by every big brand ranging from cars to shoes to laptops to even holiday packages. With the newly gained earning power and lack of big responsibilities, it is natural that spendings on entertainment, gadgets, accessories, hanging out / parties, etc. form a big chunk of the spendings. Surely it is the time to enjoy life but young adults are advised to control their urge to splurge and not make impulsive decisions. It would be great if one can budget such spendings and avoid taking big decisions like buying motorbikes, cars, laptops, etc. without adequate thinking and research.

4. Start investing immediately:

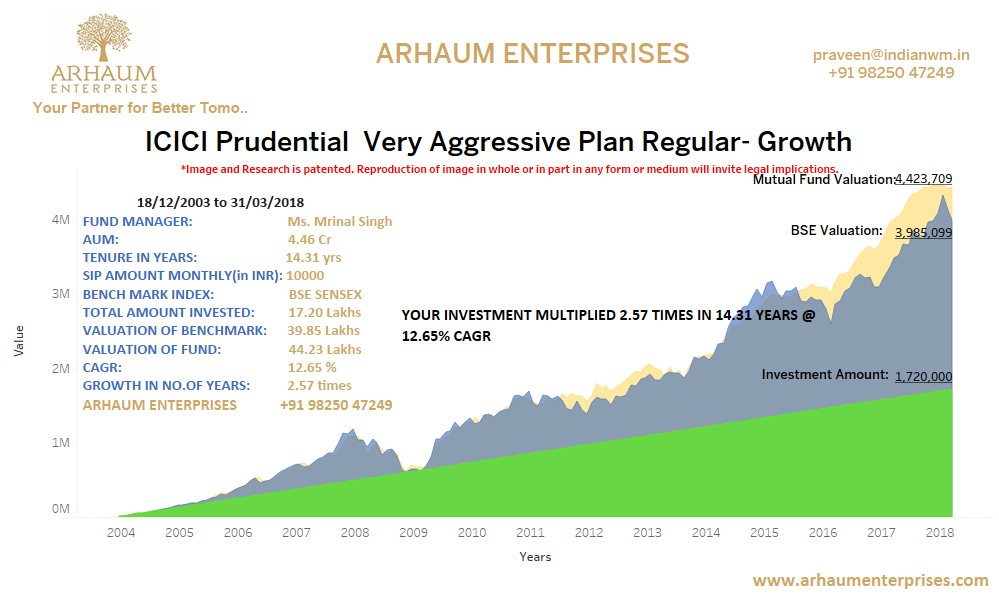

We have often spoken on this topic. The benefit of saving early can never be under estimated. Even if the savings is small, with the power of compounding, the wealth created by you can be enormous, as seen from the following matrix.

In the above e.g., Mr. Delay would have to invest thrice the amount, or R 3,000 monthly, saved by Mr. Smart if he wants to match the wealth created by him at age 35.

5. Get PAN & start filing tax returns:

PAN card can be issued to any person, irrespective of whether there is any earning or not. And, if you have started earning, it is best to start preparing & filing income tax returns (ITR), unless exempted. Filling of ITR has many advantages as it is considered as a standard income proof globally and can help you while applying for loans, visa applications for jobs abroad, requesting tax refunds, etc. The PAN issued by IT authority is a prerequisite for filing ITR and is also mandatory for all financial transactions. So it makes sense to get yourself one, even if you don’t have much income.

6. Get health & life cover

Getting adequate protection at a young age, where people tend to be more adventurous, is highly advised, even if there aren’t any dependants on you. Buying health or life cover at a younger age is also considerably cheaper than buying the same later. Such protection can really help one, in case there is any unforeseen emergency and financial burden on parents will be avoided.

7. Start thinking about home

The average age of home & car buyers has decreased dramatically in the last 20 years. Powered by easy availability of loans, fat pay packages & growing aspirations, the first time home buyer today is often around the age of 30. The first time car buyers are even younger. It would thus be best advised that young adults keep these goals in mind and start saving as much as possible for home & car goals, if any, from now onwards. It would really benefit you a lot when the time comes for purchase in near future. Often young adults delay saving for the goal and end up paying lesser down-payments and taking higher amount of loans which should be avoided. Lastly, even if you have a house of your own, it is advisable to think of buying a house as an investment for future and also enjoy tax benefits on same.

Conclusion:

Having time on your side is a great advantage and never to be missed. It is also the time that you can afford to make mistakes while learning – this is a luxury which most people cannot afford at the later years of their lives. Experience has shown that wise decisions, actions and discipline in these formative years go a long way in securing a better financial future down the line. Simple actions taken today can help you avoid taking tough decisions at times when you have a family to support and lot of responsibilities to be taken care of. So go ahead and make the best of this time.