To understand how to build a portfolio, we need to understand what the term means and what it implies. This is necessary to understand what role a portfolio plays. A portfolio is actually a leather bag, a type of briefcase. No, seriously. The original meaning of the word is simply a bag designed to carry documents in.

Subscribe to the free Value Research Insight newsletter

It became associated with investments because in the early twentieth century, stockbrokers would keep each client’s share certificates in a separate portfolio. From there onwards, the word gradually came to mean any kind of collection of documents. In finance, it specifically mean the investments held by an investor, generally all the investments that an investor has.

However, the word’s meaning in personal finance has evolved a great deal. At Value Research, we don’t think it makes sense to use the word to just refer to a collection of all of someone’s investments. A portfolio is a lot more than a collection. For individuals, the best way to plan their investments is to have a separate portfolio for each financial goal.

Different mixes of funds, stocks and other assets lead to different risk levels and different gain expectations. Most people find it difficult to match these to what they want. If you’re asked, ‘What is your risk level?’ you’ll probably give an answer of some sort but it will just be a gut feel thing.

However, if you think of specific financial targets and think of the money needed for them, then you will be able to answer questions about risk and returns precisely. For example, you’ll need money for your daughter’s higher education after three years. You’d like to buy a house at least ten years before retirement. You’d like to go on a vacation to Europe after two years. You’d like R2 lakh to always be available for emergencies.

Each of these goals is very precise. The risk you can take with it, as well as the amount of money needed can be quantified quite precisely. Therefore, it is relatively easy to decide what kind investments should be made for each of them. In the Value Research way of thinking, there is no concept of an individual’s portfolio. Instead each individual must have many portfolios, one for each financial goal. The other important thing is that a portfolio is not simply a collection. It has different parts that fit together in specific roles and complement each other. There could be three funds, of which one provides gains and two stability. In hindsight, it’ll later appear that you could have stuck with one or the other but both types played a role.

With experience, you’ll learn the basics of constructing a portfolio as well as learn about some model portfolios.

How to build a Portfolio

The first step towards building a portfolio is to have a clear goal. Once you have that, then it’s relatively easy to build the rest of the portfolio in a way that’s suitable for meeting your goals.

In Value Research’s way of thinking, goals that need to be fulfilled in the short-term are fundamentally different from long-term goals. Short-term goals are best fulfilled using fixed-income investments. These could be a bank or a fixed deposit or it could be a post office deposit.

If you are saving gradually towards such a goal, then the post office recurring deposit is a reasonable tool. It yields a return of 7.5 per cent per annum. However, this should only be used for savings targets that are no more than two to three years away. Any longer and the ill-effects of the low returns will start becoming more and more meaningful.

For fulfilling long-term financial goals, the best option is to use a portfolio comprising of equity mutual funds. As we have read, equity is the only type of asset that can ensure that your money grows faster than inflation and does not actually lose value in real terms. Fixed-income investing is safer, but generally cannot beat inflation.

However, equity mutual funds can be volatile and thus only suitable for long-term investments. Over the short-term, the ups and downs of the stock markets could very well lead to temporary losses. Because of this, we do not recommend investing in equity mutual funds if your financial goal is nearer that about three to five years.

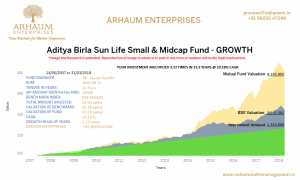

This point is beautifully illustrated in the accompanying graph. This graph traces the growth of an investment over ten years in three different types of investments. We have chosen three types of funds and calculated the average performance of all funds that are more than ten years old. What looks risky in the short-term can work very well in the long-term. What looks like volatility can actually bring great returns.

Two of these funds are equity oriented. Of them, one invests in large companies while the other invests in smaller companies. The third type are very short-term fixed-income funds called liquid funds. These funds are heavily regulated to be closest to risk-free investments. For the purpose of understanding returns in this graph, they can be considered equivalent to bank and other deposits.