ELSS Mutual Funds or Equity Linked Saving Schemes offer you a simple way to get tax benefits under Section 80C of The Income Tax Act 1961, while aiming to make the most of the potential of the equity market investing. Therefore, if the question how to save tax is bothering you, you can have a look at investing in ELSS tax saving mutual funds!

ELSS tax savings schemes are an open-ended equity mutual fund that doesn’t just help you save taxes, but also gives an opportunity to grow your money. It qualifies for tax exemptions under section (u/s) 80C of the Indian Income Tax Act 1961. Equity Linked Saving Schemes (ELSS) are essentially diversified equity mutual fund schemes, which invest in a diversified portfolio of stocks across different sectors and market capitalization segments for generating capital appreciation for investors over a sufficiently long investment horizon.

Section 80C and how do the deductions work

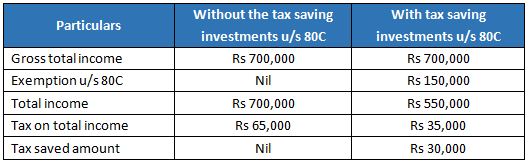

If you are worried about how to save tax, please note that when you invest in certain schemes like ELSS Tax Saving funds, Public Provident Fund (PPF), Tax saving bank fixed deposits, NSC and Life insurance premiums etc. you can claim up to Rs. 150,000 in a financial year as a deduction from your gross total income under The Income Tax Act, 1961.

The Table below will help further explain how this works –

(Illustration of Tax exemption for an individual less than 60 years in receipt of salary income for the assessment year 2019-20)

From the above chart you can see that, if you invest Rs 150,000 in any investment option under Section 80C including Equity Linked Saving Schemes, you can save substantial amount of taxes.

Why invest in Tax Saving Mutual Funds?

-

-

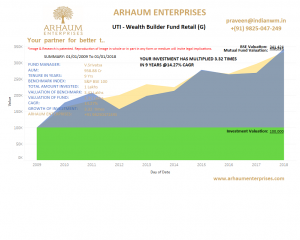

High returns

– By investing in tax saving mutual funds, you get an opportunity to grow your money by investing in equity mutual funds. In the last 5 years, ELSS tax savings mutual funds category average returns have been over 18.50% annualized (source: Valueresearchonline)

-

-

-

Tax efficient

– Long term capital gains (LTCG) realized from ELSS mutual funds is taxed at only 10% if your total capital gain in the year of withdrawal is over Rs 1 Lakh. There is no capital gains tax if the total profit is less than Rs 1 Lakh in a FY. There is also no short term capital gains as the units of ELSS mutual funds are locked-in for 3 years from the date of investment.

-

-

-

Least lock-in period

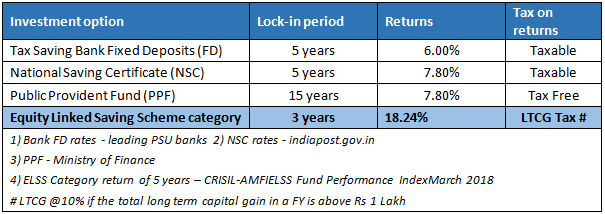

– ELSS mutual funds has the least lock-in period, i.e. only 3 years compared to PPF which is 15 years and NSC and bank fixed deposits which is 5 years.

-

-

-

Dividend payout option

– You can opt for dividend payout option on your investments in ELSS mutual funds. It helps you realize some potential gain during the lock-in period of 3 years. However, if your investment horizon is long and you do not need any earnings in the interim, you should opt for the growth option. You must also note that dividend payments are made from the NAV of the Scheme and therefore, the NAV of the scheme will fall to the extent of the dividend payment on the date of dividend. Dividend payments are also subject to availability of distributable surplus/ profit made by the scheme and totally at the discretion of the fund manager.

-

-

Systematic investing

– If you do not have lump sum amount in hand and worried about how to save tax, you may start investing in ELSS mutual funds through systematic investment plans (SIP). SIPs help you invest a fixed amount every month on a fixed date in the ELSS mutual fund scheme of your choice. A SIP inculcates the saving habit and brings a sense of discipline in you without having to worry about investing a big amount at the end of the financial year for saving taxes.

Features of ELSS and other tax saving instruments under Section 80C

Let us now compare the features of Equity Linked Savings Schemes and other popular tax saving investment options under Section 80C of The Income Tax Act 1961.

As you can see in the above chart the feature of ELSS Mutual Funds are most attractive as it has the least lock-in period of 3 years and the potential returns are much more than the returns of any other tax saving investment options. Over and above this the returns of ELSS mutual funds are tax efficient too!

Therefore, knowing how to save tax is important but knowing where to invest for saving taxes is even more important. Even though the investments in tax saving mutual Funds are subject to market risks, they are one of the best tax saving investment options for investors with a long investment horizon. ELSS mutual funds has given annualized returns of over 18%, 12% and 11% respectively in the last 5 years, 7 years and 10 years period (Source: CRISIL – AMFIELSS Fund Performance Index March 2018) which makes it the most attractive investment option for savings taxes provided you are ready to take a bit of risk with your investment.