It may be expected from the blogs at this place, regardless of the topic, that it’ll revolve around the financial aspect of life. But when it comes to the growth of kids, and their financial security, with sufficient experience and observation, you will figure that no matter how strongly you secure your kids’ future financial position, stability and growth only happens by developing requisite skills and understanding of the world around.

Therefore, I’ll start with essential financial measures you must take as a parent to ensure a safe financial journey for your kids, but will extend the text to include ways to ensure that your kid’s future is secure even without your money. First we start with the steps to provide for the minimum required financial security to your kids and any other dependents:

1. Life Insurance

Life insurance is the most basic of the tools, to start with once you have any dependent. Since for first 20 – 25 years of life your kids are going to be financially dependent on you, it is important that this dependency is safeguarded and provided for even if you are not there to provide for it. Your next question may be about how much is needed, so there is a detailed analysis of future requirements that can be done by your wealth manager/ financial planner.

In case you are yet to consult an advisor, and want some cover immediately, you may go for a term cover of 10 times of your annual income; i.e. if your income is Rs. 10,00,000 p.a. your life cover will be of Rs. 1 cr. for which annual premium can range from Rs. 9,600 to Rs. 15,000 depending on the insurer services.

2. Health/ Disability/ Critical Illness (C.I.) Insurance

Health insurance or disability insurance is more important than life insurance for you, as one must have a health insurance even if he/she does not have any dependents. Main reason being, disability or bad health may curtail your earning capacity and badly damage your long term financial scopes by digging into your existing savings.

When you have kids to look after as well, their health also becomes an important factor. Starting FY 2014-15 you can also get a deduction of Rs. 5000 on preventive health care expenses, but given the rising cost of medical expenses that may not be enough. The way out is to look for a health insurance policy that gives you both hospitalization cover and reimbursement for health checkup expenses.

A reasonable amount for individual health policy given the future level of costs is Rs. 500,000, but again if you can afford you may go for higher Sum Assured (S.A.). For Critical Illness, expenses may be even higher and thus usually at least 4 times of S.A. is recommended for C.I. policies of that of health cover. E.g. if you have a health cover of Rs. 5 Lakh you can go for a Rs. 20 Lakh C.I. cover.

3. Emergency Fund

Emergency Fund is that money, which fills the gap between insured costs and regular expenses, for example job loss, or any other financial emergency, not covered by any insurance policy. Also sometimes you may have to bear some amount of expenses out of your pocket before you can get the insurer to cover the costs. Emergency fund comes in handy in such situations.

Most of the money for emergency fund is kept in fairly liquid investments like, Super Saver accounts, easily accessible fixed deposits or Money Market Funds. The amount of emergency fund depends on your monthly expenses. Though, it’s better to let a qualified financial advisor give you this estimate after a thorough study, in general you may follow the rule of 4 – 6 months of expenses as emergency fund.

Another major benefit of emergency fund is that even when your financial situation becomes tight, your long term financial goals will not be harmed by sudden and temporary setback.

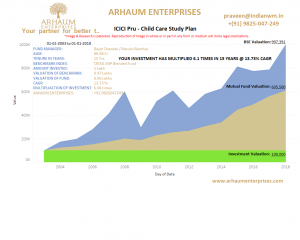

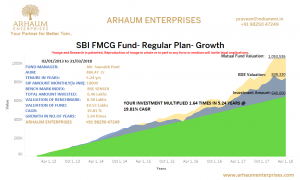

4. Regular Goal Based Saving

After you have completed the contingency planning, time is to pack your bags and start moving towards the long term goals with peace of mind. Again it’s recommended that you take assistance of an advisor to plan your goals thoroughly, but just in case you are not, this is how you go about them:

Step 1: Write all your goals.

Step 2: Put them in a priority order

Step 3: Estimate current cost of these goals

Step 4: Multiply this cost by the multiplier given in the table below, depending on the number of years to the goal:

|

So, for example, current total cost of your kid’s marriage can be Rs. 10,00,000, but his/her marriage is due in about 20 years from now, therefore approximate cost of it will be around Rs. 35 Lakh (10,00,000 x 3.5). Though, remember that this table only provides an approximation actual expenses may vary widely if there is high inflation.

Step 5: Determine the monthly saving required for the goal by dividing the future cost calculated above with the number of months available to that goal.

E.g. in the above example: Marriage expense comes out to be Rs. 35 Lakh, but it is 20 years or 240 (20 x 12) months away. Thus, if you save Rs. 35,00,000 ÷ 240 = Rs. 14,583 per month, you can achieve this goal.

Again, however, this kind of calculation does not provide for interest earned on saving so you may simply reduce the monthly investment amount to some extent.

Step 6: Start investing in the following manner:

|

Important Things to do Other Than Investment and Insurance

Now that, you have financially prepared yourself to tackle almost every need of your kid, you need to think ahead and prepare your child for the challenges of the future. Following steps can be taken to allow kids to develop their skills and understanding:

1. Confidence Building in Kids

You may have seen that, confidence in people define their financial success. Confidence itself on the other hand comes from certain external and internal factors, such as beliefs, values and small successes. The internal level of confidence may exist in kids but it also requires nurturing and external support to grow and become strong. This can be done by two very small acts:

- Freedom to experiment: Teach kids how to handle failures, and learn from their mistakes, rectify them and try again.

- Measure success: Success if measured simply in mind can be overrated or underrated, generating unreasonable emotional exhilaration or anxiety. Both are dangerous for long term success and confidence. Thus, teaching kids about measuring their successes on practical parameters is a good way to build their internal confidence and self-belief.

5. Help them identify issues and overcome obstacles in life In today’s world no one can claim to know everything or have seen everything, but we can always try to know what went wrong or what is being a roadblock in our success. With your experience of handling some of the issues you faced in your life you can help your kid to develop that intelligence and wisdom to look ahead and tackle small and big obstacles in their lives. Important thing is to develop that methodical thinking which divulges and explores the details rather than simply skimming the surface and getting emotionally bogged down by the issues.

The richest people in the world look for and build networks; everyone else looks for work. – Robert Kiyosaki

6. Making them financially literate

Financial awareness is another important aspect of life, you can look at it in the way that when you had been a kid only formula for money was to keep your expenses as low as possible and save money. But with time saving alone is not enough, knowing true nature of money and how it can be multiplied is also required. Moreover, this step sets up the right expectation in your kids’ mind about money.

7. Giving them exposure to face the world

Since, world is made up of lots and lots of people, it is important to know as many people as possible and know how to deal with them, in short ‘how the world works?’ Motivating your kids to participate in community projects, speak up their minds on issues even if they are among quite senior and serious people, will give them confidence and courage to hold their point and participate on the stage, rather than just sit among the audience and clap.

8. Helping Kids to work on their dreams

Finally, with all the internal qualities and confidence, the last straw that makes any one successful is his/her vision for life. Kids, you will find are good at developing and harboring their own very unique vision of their world, need is to help them shape it so that they can go out and live those dreams and be successful in the way they want to be successful. After all, each individual has a different definition of success, but the result for each is almost the same level of gratification and prosperity.