Mutual funds can help investors create wealth over the long term powered with disciplined savings and patience in the right asset class.

Equity mutual funds have been able to outperform all other classes of investment over a long period of time. Let’s say you had invested R 1,00,000 in a fixed deposit 15 years back at an interest rate of 8% (half yearly compounding), it would be worth R 3,24,340* today. If you had invested the same amount in a diversified equity mutual fund, it would have been worth R 22,12,423* today, i.e. almost 7 times more than what you got in the Fixed Deposit. (* % returns in diversified equity schemes is 22.93% for 15 years)

“If you want to make big money, go for a large number of smalls”

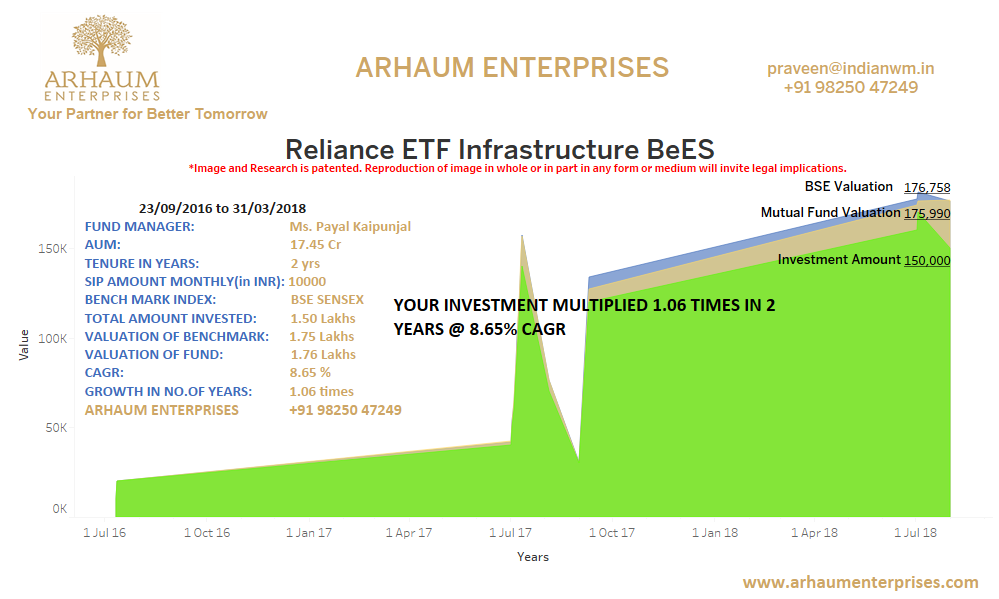

Investing in Mutual Funds has become convenient and simpler with Systematic Investment Plan (SIP) option. SIP is a tool which enables us fulfill our dreams comfortably. SIP is a disciplined approach towards investing in mutual funds. Apart from being a disciplined & convenient approach to investing, SIP enables the investor to benefit from Compounding & Averaging.

So, those investors, who started believing in mutual funds, they gave it a shot with small SIPs, they started SIPs in the last 4-5 yrs to experiment as they were doing it for the first time. But the irony is, even after their incomes have increased, the SIP amounts are still the same. Neither have the number of SIPs increased nor their contributions. Their SIPs performed well over the years and have helped them get closer to their goals while creating wealth. With an increase in income, the savings should increase, and ideally this will lead to a proportional increase in investments. It means that you can target for bigger goals, with your present income. A right increase in your SIP, can help you achieve larger goals.

Let us see what a small difference can make to your wealth. Ram started an SIP of R 5,000, 5 years back in a diversified equity fund. His investment’s worth today is R 488,149*, against his investment value of R 3,00,000. Shyam stretched his savings a bit and started an SIP of R 10,000 in the same fund at the same time. The value of his investment today is R 9,76,298*, against his investment value of R 6,00,000. The pains of saving extra R 5,000 monthly by Shyam is today greatly outmatched & compensated by almost R 5 Lacs of extra wealth he managed to create over Ram. (*% SIP returns in diversified equity schemes is 19.55% for 5 years: Source NJ Research)

You must also periodically review your goals and your income. You may now want to go for an international vacation, while your previous goal was a trip to Kerala. Or, you had started an SIP for your son’s education, but now you have a daughter too. So, in order to meet higher goals and invest the extra savings, you must increase your SIP’s periodically. You shall start a new SIP for your daughter’s education, as it is a new goal, and the maturity date would be different and you can increase the value of the SIP for your vacation.

Today you might not be able to afford a larger SIP for your retirement, because of higher expenses and other commitments . Your retirement is due 20 years hence and you may want to have a huge corpus created at that time. You shall explain your requirements to your financial advisor & he will help you find your optimum SIP value which will help you in achieving your goal. He will guide you and will suggest a smaller SIP, in case you don’t want to go for a higher SIP currently, so you can make the start and as and when you move ahead in life, with higher incomes, he will help you in gradually increasing your SIP amount. You will also be meeting your other life goals with time, and the amount used in SIP’s aimed at achieving these goals can also be directed towards your retirement goal.

The master plan to long term wealth creation and actualization of distant goals is ‘Increase your SIP regularly’. If you do more SIP today, probably you can retire earlier and buy a bigger house than expected and go for a Europe trip rather than South Asia. At the end of the day it is your money, in case of troubles you can always redeem it or stop the SIP, till such time, it makes more sense to increase your SIP for future rather than upgrading to an I phone 7.

So, the bottomline is although your present SIPs will help you achieve your present goals. But your saving will increase with increase in your income each year and it should be invested and secondly, the quantity and quality of your goals will also change, which will require more and higher SIPs. You must contact your advisor and ask him to review your goals and help you decide the right SIP amount for you. The review should be done periodically, so that you don’t lose track. Increasing your SIP is not a hectic task, but it is very important and should not be ignored. It is as easy as shopping on an App, you just have to go to the NJ App, and do the needful.