My yoga instructor once told me, “Yoga is like SIP. The results will definitely show over time.” This rang a bell. How many of us think of wealth and health on similar lines? Do we invest in our health and wealth regularly? When we don’t, the usual response from most of us is that there is time to catch up at a later date with these two important pillars of our lives.

Subscribe to the Value Research Insight newsletter

The great artist Pablo Picasso, an influential modernist painter, once famously quipped, “Action is the foundational key to all success.” When it comes to taking care of your health and wealth, the same foundational key rings true for all of us.

Once we start postponing matters, we tend to keep postponing till it is rather too late. Because of the many distractions around us, we think we can catch up with our health and wealth goals in the future. This is far from truth. Recall the tortoise and hare story.

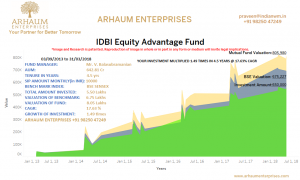

We have to start investing now in our health, and wealth, and persist. And one way to be consistent with both is to weave automated routines into our everyday lives. For instance, investing through a systematic investment plan (SIP) can done easily through your bank account.

Even making greater investments over time can be put on autopilot, as increasing the SIP’s amount is now just a click away. Once you put a plan in place and take action, the process works for you without the need for any additional effort on your part.

Likewise, with health too, you have to create a system where taking action on health becomes a routine, without the need for conscious intervention. Create and block a time for physical activity and weave it into your daily schedule till it becomes a routine. You can also create a predetermined action plan for investments-as you do for exercising and healthy eating-and this can serve as a long-term guide for your health- and wealth-related goals.

Another strategy that serves us well for long-term wealth and health is to strive to achieve a balance. Let’s begin with keeping our health in balance. For example, if weight gain is a problem for some of us, we can safely assume that calorie intake is out of balance. In this case, the simple cause would be that we are absorbing more calories than we are burning: energy intake and energy use are out of sync. A simple solution could be to consume fewer calories and burn more.

It is the same with investing. We have to achieve a balance between saving and spending. Needless to say, spending more and stretching your finances can lead to debt accumulation and difficulties in meeting the goals. To maintain a balance, you have to create a positive cash balance between income and expenses, and channelise these positive cash flows to make investments regularly in various asset classes.

Maintaining a healthy asset mix, or a proper balance between equity and debt, goes a long way in ensuring that you achieve your goals without losing your risk appetite. At times, the price of assets can go over the top, or vice-versa. That’s when a balancing act between equity and debt, via a balanced fund, becomes important. With a balanced fund, one automatically enters an asset when its price is reasonable, and exits when the price shoots up.

Lastly, don’t hesitate to seek help for maintaining your optimum level of health and wealth. It goes without saying that you have to see the doctor when you are not well. But you can stay healthier by turning to professionals such as fitness coaches and yoga instructors, who can instil a routine and good practices in your health plan. For example: a personal fitness coach will make you to hit the road, even if you are not in the mood for exercising. And this regular effort will reflect in your health over time.

Likewise, when it comes to investing, taking the help of a financial planner or investment adviser goes a long way in maintaining the fitness of your wealth. Your adviser can assess and make tailor-made plans, depending on your goals and current income. She also helps you choose suitable financial schemes to help you target your goals, depending on your financial situation. She will help you correct the course of your financial plan, just the way a fitness instructor comes in to change your exercises to target specific areas of your body.

And finally, to put all of this into practice, it is a must to make this a part of your regular routine. The key is consistency. The great investment thinker Ben Graham had said: “The individual investor should act consistently as an investor and not as a speculator.”

Staying consistent means putting your wealth and health on a regular schedule. Ask yourself how you can inculcate the good habits of saving and staying healthy. And strive to catch up if there is a deviation from the plan.

If you find yourself eating more, cut back on calorie intake the next time. Similarly, if you overspent in a month, don’t hesitate to double your investments the next time.

Good financial and health practices are a lot like practicing at the nets regularly. The results will show over time.

Nimesh Shah, managing director and chief executive officer, ICICI Prudential Asset Management Co. Ltd.