It’s easy to be swept away with the current, upbeat market mood! Keep the following BEES tips in mind before you take the leap:-

If you are targeting DIVIDENDS

The reason why balanced funds gained popularity was because of their ability to create wealth while also offering a safety net of debt. However, recently they have been pitched to customers as a source of generating regular income through dividends. Since these dividends are met out of distributable surplus accumulated by them, there lies a risk exposure on account of a bearish market. As an alternative, we advise to consider SWPs and have a better control on their financial goals.

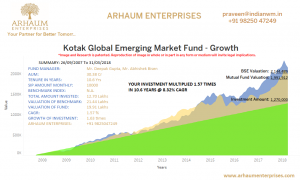

If LONG TERM is not your cup of tea

Since the market is at its peak, expecting short term gains is bit of a longshot. If mutual funds continue to be your investment of choice, be ready to be committed for a longer period to earn the desired returns. The market could see bit of a downturn if investors look to book profits at these levels and hence, your investment horizon will be critical to enter the market at this point.

If you are thinking of PROFIT BOOKING

In the aforementioned tips, we highlighted the need for caution for investors thinking of taking a fresh position or entering the market for the first time at these levels. However, for those already invested, we suggested you stay invested. This will help you gain from compounded returns over your investment lifecycle.

If your dilemma is : MID-CAP or LARGE-CAP

Mid-cap funds have won over investors’ hearts over the last three years with 23% annualized returns. On the other hand, small-cap funds did not disappoint either and attained a 17% annualized return during the same period. This has resulted in a comprehensive victory for them over their influential peers : the Large-Cap funds. But yet again, we would like to emphasize on the importance of staying invested in mid-cap & small-cap funds & not enhancing your exposure therein. Their recent returns are surely tempting, but their volatility should keep the temptation in check.

If you think you don’t NEED EXPERT ADVICE

The need for expert advice has never been more prominent. When the spirits are high, every investor tends to believe that he has got it all figured out. However, the ‘real experts’ can help you decide the type of fund most suited to your risk profile, your quantum of exposure and most importantly, time your market entry & exit.