No one can predict equity market. Right? But the other side of the coin is that no one can create wealth by ignoring equity market. Equity market becomes more predictable with the increase in investment horizon, and we have discussed and proved this on many occasions. The fact of the matter is that equity is best suited to help investor meet financial goals in life with the potential of generating inflation beating return, but another equally important fact is the inherent volatility of equity, specially in a short term of less than 5 years.

Financial goal based investing is at the core of any investment exercise., After all we all save and invest to achieve a specific goal or need in life, which can be to provide good education to our kids or to spend on their marriage or simply to have peaceful, worry free retirement. With the right advice of your financial advisor, you invest in the right asset class, generate return as expected or even exceed that, and reach the desired corpus required to meet a specific goal, but imagine a situation when equity market crashes just few months before you actually need that money, or a bank/company goes bankrupt in which you had put fixed deposit. Remember co-operative banks and many companies going bust in late 90s or recent crash of equity market in 2008.

Lets imagine Mr. Shah, who had been investing in diversified equity funds through SIP for last 10 years to save for his son’s higher education, which was due in 2009 for which he required to pay fees in March/April 2009. He was a happy man in September 2007, as he had not only built the required corpus, but in fact had exceeded due to strong market rally and super performance of equity funds in which he had invested. His joy multiplied manifold in January 2008 with the increasing value of his portfolio. This strong rally of equity market tempted him to continue out of sheer greed to earn more. But come March 2009, his portfolio was down by more than 50% and he had to arrange for his son’s fee from other sources.

Time Horizon and Risk Factor

These two are inversely proportionate to each other in case of equity investment. As investment horizon increases, risk reduces, and vice versa. Equity investment can prove highly risky with anything less than 3 years of investment period, but becomes more predictable with reasonable period of above 3 years. A common mistake that investors make is, they try to chase equity return in short term and lock long term money in fixed income product like PPF for 15 years. Ideally it should have been the reverse.

These two are inversely proportionate to each other in case of equity investment. As investment horizon increases, risk reduces, and vice versa. Equity investment can prove highly risky with anything less than 3 years of investment period, but becomes more predictable with reasonable period of above 3 years. A common mistake that investors make is, they try to chase equity return in short term and lock long term money in fixed income product like PPF for 15 years. Ideally it should have been the reverse.

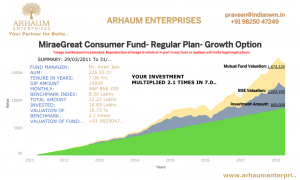

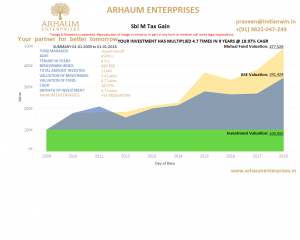

As can be seen from the below graph, if someone invests Rs. 50000 every year in both PPF and equity fund, over a period of 20 years, then equity fund clearly outperforms PPF. At the end of 20 years, an investor makes Rs. 24.71 lakhs in PPF while the same amount grows to Rs. 58.9 lakhs in equity fund.

Let us try to understand by putting numbers in the above example of Mr. Shah. Lets assume that he started SIP in 1999 and he wanted Rs. 7 lakhs for his son’s education, when he reaches 17 years of age in 2009 (in approx 10 years time). His monthly SIP need was Rs. 2868 so he started with Rs. 3000 of SIP (assuming modest return of 13% per annum).

Eventually he got return of 20% during period of 1999 to 2008 and reached the figure of Rs. 7 lakh in the beginning of 2008. (when SENSEX was touching 20000 for the first time). Greed overtook rationality, and Mr. Shah wanted to cash in market rally and continued with his equity investment. We all know what happened to equity market between January 2008 and March 2009, when he actually wanted the money. SENSEX was down by around 50% and so was his portfolio.

Isn’t this a very practical example? Many times we come across this kind of situation, when we find equity market at a low level, specially when we have need of the saving. What to do in this kind of a situation?

Conventional wisdom says that one should start shifting money from equity to debt as one reaches near his/her financial goal. Considering the inherent volatile nature of equity, it is always prudent to shift corpus from equity to debt, and ideally the entire amount should be in debt for at least 1 to 2 years prior to the actual need. This can ideally be done in two ways:

Opt for Systematic Transfer Plan (STP)

This is the facility available in mutual funds under which an investor can give standing instructions to transfer money from one fund to another. As one approaches the goal, STP instructions can be given to start switching funds from equity to short term/liquid funds to protect any potential downside from equity.

Shifting: As discussed, switching of invested money should ideally start around 1-1.5 year prior to the actual goal. As the objective here would be to protect any downside and not return optimization, short term/money manager funds can be an ideal option or one can also look at 1 year fixed maturity plans (FMP).

The idea here is to protect the funds created over the years. When you start investing, focus on equity, take maximum advantage of power of compounding and invest through SIP over the years. Switching to liquid/short term funds should start either as soon as investor reaches the desired amount or at least 1.5 to 2 years prior to the actual goal.

E.g. With our example of Mr. Shah, he could have started switching funds from equity to short term money market funds in the later part of 2007, as he reached his desired amount of Rs. 7 lakhs or could have simply put that money in 1 year FMP product. This would have not allowed him to participate in future rally but at least his money would have been secured and even during that 1 – 1.5 year period money would have generated inflation beating return.

Ideally, it is advisable to shift the amount required for a specific goal to liquid/short term funds at least one year or year and half ahead of actual requirement to protect any downside or it can be done as soon as required amount is reached, irrespective of the time horizon. Whatever path you take, prudent investment approach suggests to realign your portfolio in favour of debt to protect the amount you have built to meet your specific goal.