BIRDS AND THEIR YOUNG: You must have often seen a nest in the corner of an attic below the stairs of your house, or on the pot hanging in your balcony or on a tree in your backyard. You must have also noticed a bird or two fluttering around that nest, a cat on the lookout for food, the small eggs and the next generation of baby birds crawling and eventually flying out into the world. But have you ever thought of how the parent birds look for a safe place, make the nest, breed and hatch the eggs, protect them from wind, rain, storm and against the evil cats and raise their baby to the point when they can fly independently. It is because of their fostering, protection and the care that they offer to their young ones, are the latter able to carry on their legacy. The entire process is a challenge, and the birds invest huge efforts in winning the challenge. This story is an illustration for the readers to understand the importance of protection and care. It is very important to create wealth by investing your money wisely, yet it is all the more important to protect your wealth from evils. The assets that you have built can be blown up in a moment if you do not provide adequate protection. Changes and uncertainties are constant, and by protection we mean you should be prepared for and be able to shield your wealth from these uncertainties.

We have brought certain rules & strategies that you may follow in order to protect your assets:

Diversification: The Golden rule to protect your assets is “Don’t put all your eggs in one basket” because if the basket falls, you’ll be left with nothing. Having a heterogeneous portfolio doesn’t mean you will achieve humongous returns. But is has the potential to improve returns at a given level of risk. The idea is to mitigate the negative impact of one asset with the positive ones. A well diversified portfolio is the one which will survive the jolts of the downturn. Let’s say A has 60% assets spread across health care, technology, manufacturing, infrastructure and FMCG sectors and 40% spread across Bonds, debt funds and FD’s. While his friend B has put all his money in health care and infrastructure sectors only. Let’s say both these sectors were growing, but suddenly there is a sharp fall in the infrastructure stocks. A’s portfolio of 10 different sectors and classes will cover the risk posed by infrastructure, but B’s health care alone will not be able to make up for infra losses.

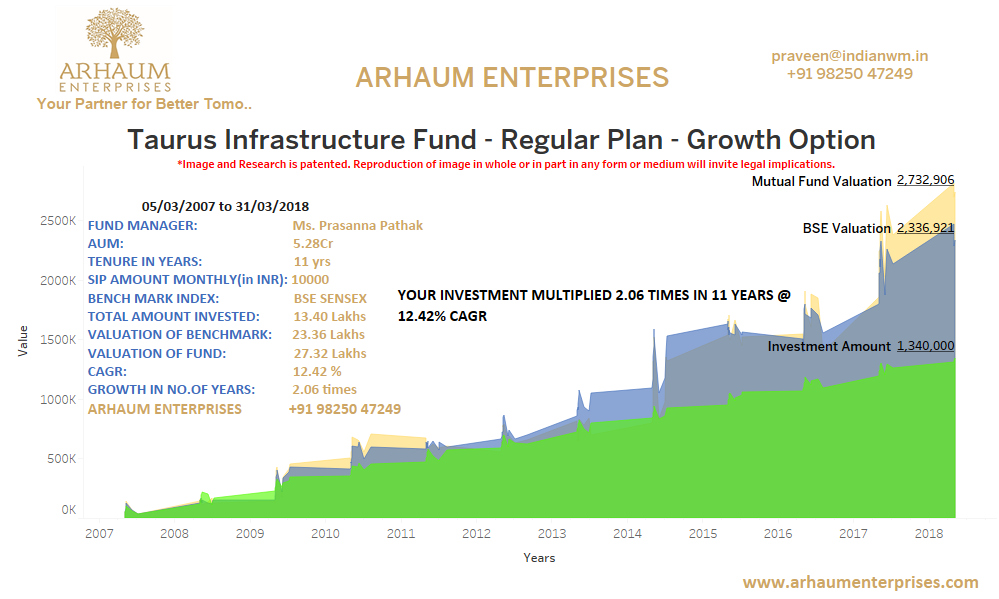

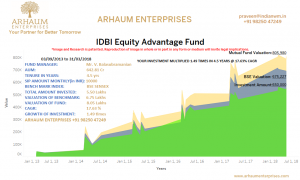

Beat Inflation: If you need R 50,000 a month to fund your household expenses today, you will probably be needing R 1 lakh ten years later to meet the same expenses. So, if you have put your money into Bank FD’ s assuming that this money will fund your life expenses post retirement, then beware!, because the post tax returns that Bank FD provides will barely cover he inflation expenses, forget about increasing your wealth. So, you must invest in options where your savings increase at a faster pace than inflation. So if you are here for the long haul, you must allocate a certain percentage of your portfolio to equities, since equities have historically delivered good returns and has overpowered inflation.

Get Adequate Insurance: Mr ABC invested some money in a mutual fund scheme for the purpose of funding his daughter’s wedding, which is expected to happen in the next 3-5 years, and suddenly his wife is detected with a tumor and she needs immediate surgery, and he is left with no choice but to meet the hospital expenses with the daughter’s wedding fund. His plans of a grand wedding are shattered and he has no clue of how will he now finance the wedding expenses. Don’t let this happen to you. Don’t be Mr ABC, you need to protect the wealth that you saved for a particular purpose by not letting emergencies overpower your goals. If Mr ABC would have got himself and his family members insured with health insurance, the emergency medical expenses would have been taken care of by his insurance, leaving his wealth untouched. You must protect your family with an adequate term life insurance also, so in case of the unexpected, your family is able to survive and fulfill the goals that you dream of.

Save & Invest More: Never stop saving and investing. Make it a habit, it will build your wealth. Even if you have allocated money for all your goals or have accomplished majority of your goals, you should never stop investing. You can blow that money up in luxury, or you can build your wealth for your better future. The latter is a better choice, since all days are not the same. Save for a rainy day. When you don’t work, your savings will work for you.

Don’t be Emotional in Money matters: Emotions are an integral part of human beings. You are a big fan of Akshay Kumar, you would never miss his movie even if it deserves an Oscar for insanity. Nevertheless, it is sane enough to invest R500 on a weekend to spend some quality time with your loved ones. But when it comes to investments, do not go by your emotions. Rather seek professional advice. Do not respond to slumps or surges, you can never make money by reacting to market fluctuations.

Follow a Personal Financial Plan: An investor must always have and follow a plan. Your financial advisor will guide you and devise a pathway according to your requirements and goals. There are various hindrances which will come in our way, some expected while others unexpected, and these will try to deviate you from your plan. But you have to be prepared and provide for these events while moving on your path unbroken. We get up in the morning, and after our morning ablutions, we pray to God, it is a daily practice. Likewise, you must make it a routine to follow your financial plan.

The above rules are like illusionary walls

around your wealth and you have to keep

these walls strong and intact to ensure that

there is no leakage at any point of time.”