It may be expected from the articles at this place, regardless of the topic, that it’ll revolve around the personal finance aspect of life. But when it comes to the growth of kids, and their financial security, with sufficient experience we figure out that regardless of our financial position, their personal financial success is dependent on the money management skills they understanding they develop in their formative years of life. Let us therefore, start with essential financial measures you must take as a parent to ensure a safe financial journey for your kids and also extend the text to include ways to ensure that your kid’s future is secure even without your money. First we start with the steps to provide for the minimum required financial security to your kids…

LIFE INSURANCE

Life insurance is the most basic of the tools, to start with once you have any dependent. Since for rest

20 – 25 years of life your kids are going to be financially dependent on you, it is important that this dependency is safeguarded and provided for even if you are not there to provide for it. Your next question may be about how much is needed, so there is a detailed analysis of future requirements that can be done by your wealth manager/ financial planner. In case you are yet to consult an advisor, and want some cover immediately, you may go for a term cover of at least 10 times of your annual income; i.e. if your income is Rs. 10,00,000 p.a. your pure life cover should be minimum of Rs. 1 crore.

HEALTH/ DISABILITY/ CRITICAL ILLNESS -C.I.- INSURANCE

Health insurance or disability insurance is more important than life insurance for you, as one must have a health insurance even if he/she does not have any dependents. Main reason being, disability or bad health may curtail your earning capacity and badly damage your long term financial scopes by digging into your existing savings. When you have kids to look after as well, their health also becomes an important factor. A reasonable amount for individual health policy given the level of costs today is Rs. 5,00,000; but again if you can afford you should go for higher cover. For any critical illness, expenses may be even higher and hence protection cover against same should be at least 2 times of the health cover. E.g. if you have a health cover of Rs. 5 Lakh you can go for a Rs. 10 lakh of minimum cover for critical illness.

EMERGENCY FUND

Emergency fund is that money, which fills the gap between income and expenses in case of emergencies like job loss or any other financial emergency, not covered by any insurance policy. Also sometimes you may have to bear some amount of expenses out of your pocket before you can get the insurer to cover the costs. Emergency fund comes in handy in such situations. Most of the money for emergency fund is kept in fairly liquid investments like, bank accounts, money market mutual fund schemes. The size of fund would depend on the nature of your job/business and extent of expenses. In general you may follow the rule of 4 to 6 months of expenses as emergency fund.

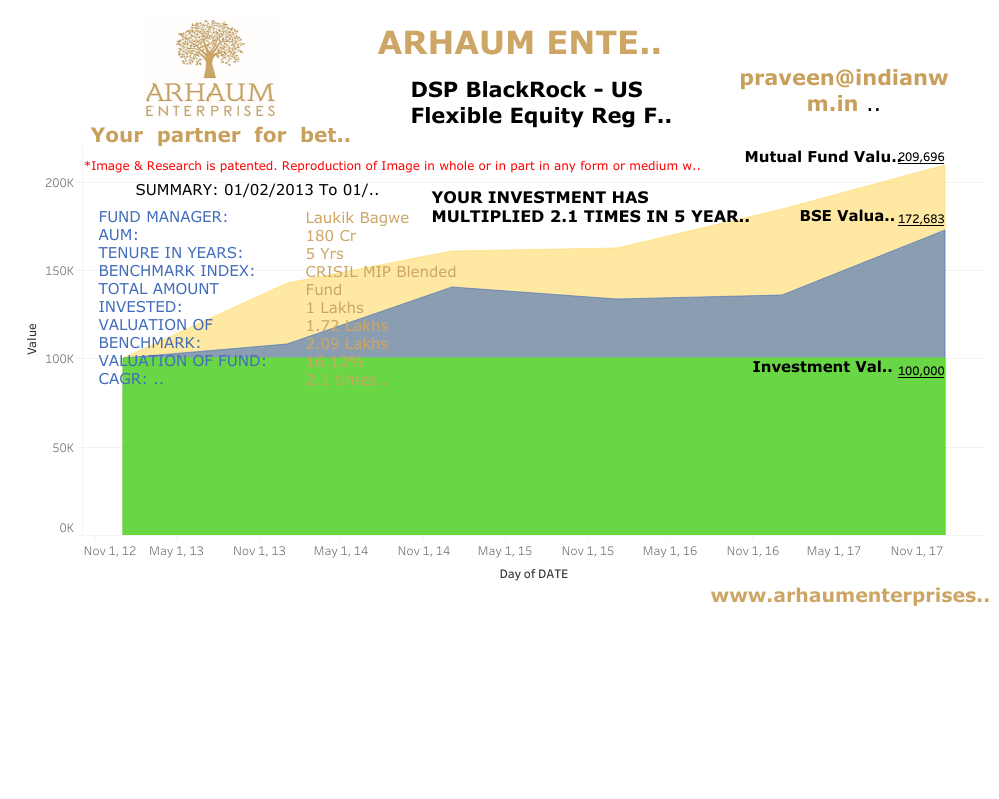

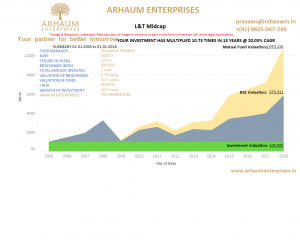

REGULAR GOAL BASED SAVING

After you have completed the contingency planning, it is time for planning the long term goals for your loved ones. Again it’s recommended that you take assistance of an advisor to plan your goals thoroughly and to arrive at the right amount for monthly /yearly savings and/or lumpsum savings. The investment avenue for your savings will depend on your required amount of savings in future and the time horizon remaining for the same. Often you may be required to save in market linked products like equity mutual funds for long term goals as traditional investment avenues may not potentially generate the wealth you need. Hence, it is advised that you sit with your financial advisor and discuss all your financial goals like child education, marriage, wealth creation etc. and save accordingly.

IMPORTANT THINGS TO DO OTHER THAN INVESTMENT & INSURANCE

Now that, you have financially prepared yourself to tackle almost every need of your kid, you need to think ahead and also prepare your child for the challenges of the future. Following steps can be taken to allow kids to develop their skills and understanding:

Engage Them In Your Budgeting Plans

For grown up kids, it is good that you also engage them in your family budgeting exercise and let them observe and understand how you go about planning savings and expenses. Let them also have say in few things based on costs and features like say appliances, etc. The learning to impart is that the income is limited and one has to manage all things within a set limit.

Have Them Prepare Their Own Budgets

You may give your kids a fixed pocket money for expenses on a weekly/monthly basis. Let them then decide how and where to spend. Be strict in not giving money beyond the budget. You may also show and encourage them to save regularly to buy valuable things after some time. The key learning would be to plan expenses, save money for future and to procrastinate non-essential expenses.

Teach Them About Personal Finance

It is good to slowly start teaching your children about all personal finance aspects early in life. You may start with opening their bank accounts. Letting them know about investment products, insurance, credit cards, loans, asset classes, etc is also a good idea. It is also important that you also show them documents, statements, etc. This will slowly let them be comfortable with these things in life and also give confidence when dealing with these things in future.

Letting Them Earn And Experiment

It is good that kids experiment and earn money in small ways. Grown up kids may earn by giving tuitions, selling things like collections, paintings, crafts, etc. One has to be careful in guiding children in small “business” ventures which they may show interest in. The idea is that they learn the basic skills of business, negotiation, etc. early in life.

Conclusion: Making your children financial secure for their future is the primary responsibility and also the wish of every parent. However, not everyone of us would have taken the necessary steps to do so. Personal financial ignorance, biasness and rigidity should not be allowed to come in way of planning the future of your children. Beyond this, one also has to make sure that you have imbibed the right money management skills and financial knowledge in children. Together, they would make sure that your dreams and your children’s dreams are realised in future.