“It’s July already, I am in the midst of the year. I’d rather start investing from the next year. New Year, New Beginnings”

That auspicious new year will never come

“I am young in my career, I am earning Rs 20,000 a month, which is just enough to meet my expenses. I’ll start investing when I start earning at least Rs 30,000 a month”.

And then you’ll say the same thing to yourself when you reach the 30,000 mark.

“This year, I am planning for a vacation to Dubai, so I need to spare some money for that. I will start from next year.”

Vacations will come and go, your Investments will stand by you in all facets of your life.

“I am waiting for the right time to invest, like when I’ll have some extra money”

Money can never be extra, you have to carve out for your investment from the money you have.

“The markets are high, Investing now will be a costly affair”

No one can predict the direction of the markets, it may never come back.

These are the excuses you give to yourself and to others. You should get over the lazy attitude and start investing now. Because the cost you’ll pay for delaying investment can be very high.

Why do we say, you shouldn’t delay investing? Why should you start investing in the early stages of your life?

What are you losing?

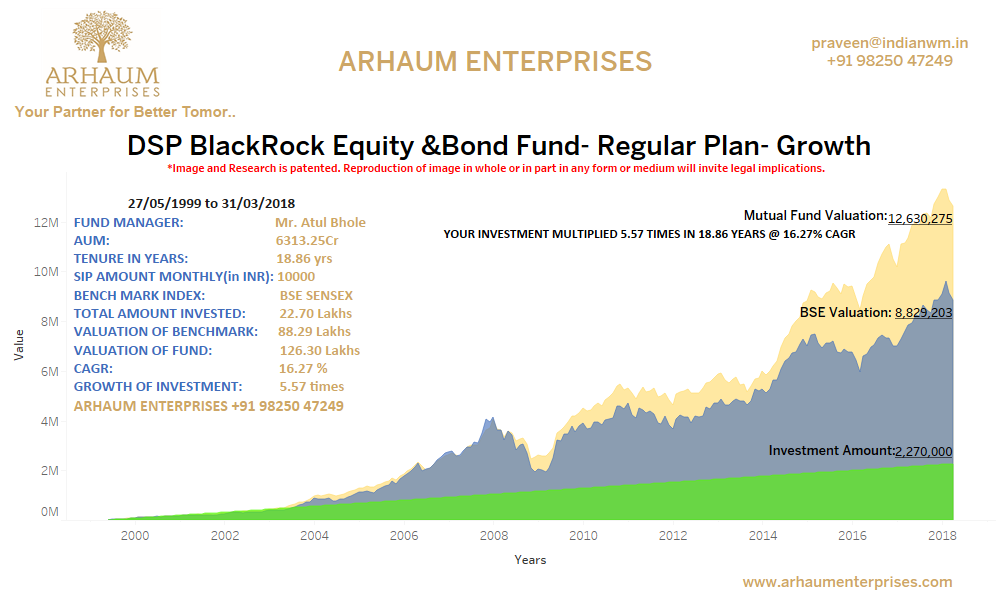

Power of Compounding: Ramesh and Suresh are two friends, both of them are 25 years old and working in the same company. Ramesh is a smart guy, he decides to start an SIP of Rs 5,000 for 10 years. While Suresh picks up two of the above mentioned excuses and he procrastinates his investing. Now Suresh realizes the need to invest after 5 years and he too starts an SIP of Rs 5,000 a month in the same mutual fund as Ramesh’s.

Their Investment comparison is as follows:

| Ramesh | Suresh | |

| Investment Date | 01/01/17 | 01/01/22 |

| SIP Ammount (pm) | 5,000 | 5,000 |

| Investment Ammount (Rs.) | 6,00,000 | 3,00,000 |

| Diffrence in Investment (Rs.) | 3,00,000 | |

| Maturity Date | 01/01/27 | 01/01/27 |

| Maturity Value | 17,21,555 | 4,93,520 |

| Diffrence in Maturity Value (Rs.) | 12,28,035 | |

* Assuming a CAGR of 20% for the overall investment period

Conclusion: Suresh, who started investing 5 years after Ramesh, invested Rs 3 Lacs less than the latter but the difference in their investment’s maturity value is huge i.e., Rs 12,28,035. This huge difference is because of the Power of Compounding, which has taken Ramesh many steps ahead of Suresh in just 5 years. This huge difference has resulted when the SIP was of just Rs 5,000 a month and the difference in duration was 5 years. So, imagine the cost you are bearing by procrastinating your Investing for decades now.

Failure to meet goals: When you delay investing, you are dragging yourself away from your life goals. It may not be easy to collect a huge corpus in a very short period of time. Consider the above example, Ramesh has Rs 17.21 lakhs at the age of 35, so he can use this money for making a downpayment for his dream home. But Suresh, who is also 35, may not be able to do this with Rs 4.93 Lakhs. So procrastinating his Investment has taken him away from fulfilling his goal of owning a house, he will need some more years for accumulating the money required for making the downpayment.

Tax Benefits: Many investments carry the dual benefit of Yielding Returns plus Saving Taxes. So, if you are the one who has not yet started investing for saving taxes also, then you are practically committing a financial crime. Let’s say, Harish falls under the 20% tax bracket, but he is too lazy to invest for tax. He shakes off the load from his shoulders by explaining to himself that “I live in India, I am paying taxes, because it’s my responsibility to contribute towards the economic development of the country”. He omits to tell his conscience that he is also paying VAT on everything he consumes, he pays road tax to drive on the roads, he pays water tax to drink water, he pays service tax on the movies he watches, etc., and all these taxes are also contributing towards the economic development of the country. Hence he must save paying Income Tax as much as he can. If Harish would have invested in a tax saving instrument, like PPF, which is giving a nominal return of 8%, his effective return is 8% plus the 20% tax he is saving, i.e. a cumulative return of 28%. (For simplicity sake, we have ignored the time value of money). It doesn’t make sense to lose out a return of 28% p.a. just because Harish is procrastinating investing. We have taken the example of PPF, if we replace it by a high return generating option like ELSS, then your money would know no bounds.

These were the three basic costs you are paying by procrastinating your Investments, there are many more that you actually bearing. The excuses are endless, but the time is not. So, stop procrastinating and Start Investing Now.