Many of us approach tax planning as a recurring headache that has to be got rid of somehow. As the end of the financial year approaches and the accountant asks for investment proofs, we tend to scramble for any tax-saving investments. Many of us even fall prey to unscrupulous salespeople, who peddle us some investment product not quite suited to our needs. Once we have unwittingly put our money into some investment, we feel the job is done. Later, we forget about the money.

Get updates from Value Research in your inbox

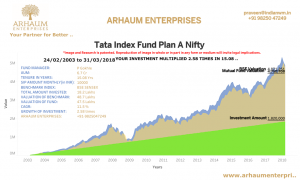

Not planning for your income tax properly is a serious investment mistake. As the process described above is repeated over the years, your chances for wealth creation are diminished. Here is how. Let’s say you invest the entire tax-exempt amount of Rs1.5 lakh in a mutual fund every year for 40 years at 12 per cent rate of return. After 40 years, you will have Rs12.89 crore. You get this enormous sum without making any additional investments but just by carefully investing your tax-saving money. So by not taking your tax-saving investments seriously, you actually lose the opportunity to build wealth in a simple manner.

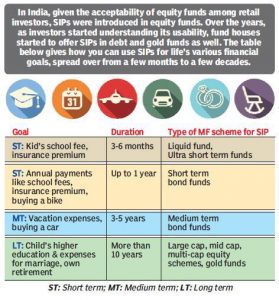

But what exactly stops us from making prudent tax-planning decisions? The devil lies in deferring the tax-planning activity to the last moment. The right way to plan for your taxes is to start investing at the beginning of a financial year, not when it is drawing to a close. By systematically investing in tax-saving plans, also called equity-linked savings schemes (ELSS), you can bring discipline to your approach.

Just pick one or two good tax-savers and start SIPs in them at the start of the financial year. You can even opt for the auto-deduction facility. With it, the specified amount gets debited from your bank account periodically and is invested in a fund. This does away with manual intervention and hence precludes missing out on your monthly investment.

Another benefit of SIPs is that they help you invest over the market cycle and hence you don’t catch a market peak. What does this mean? Let’s say you are suddenly reminded that there is something such as tax planning and you have to invest in the next two days to avail tax benefits. You quickly find an investment, say, a mutual fund. You invest Rs1.5 lakh in it in one go and feel happy that the job is over. But you don’t realise that the stock market was at its peak when you made that investment. As the stock market corrects, your investment goes into red. It takes many months or perhaps years to recoup your losses.

With SIPs, you could have avoided this. Since SIPs help you invest over the market cycle, you invest at both market highs and lows. This averages your cost. You automatically buy fewer units when the market is high and more when it’s low. A market downturn doesn’t hit you as much hard as it would have if you had invested a lump sum.

Properly investing your tax-saving money through SIPs kills two birds with one stone: you save the tax outgo and you build wealth. What else could be a better deal?