How can I save on taxes with Mutual Funds?

How can I save on taxes with Mutual Funds?

The video explains the tax saving using mutual funds.

T ax benefits of equity investments

ax benefits of equity investments

Don’t get locked up for long in tax savings investments! #unlockwithELSS

Don’t get locked up for long in tax savings investments! #unlockwithELSS

Don’t get locked up for long in traditional tax savings investments! Invest in DHFL Pramerica Tax Savings Fund! Only 3 Years Lock-In

DSP BlackRock Tax Saver Fund flv

DSP BlackRock Tax Saver Fund flv

This video explains the Tax Saver fund of DSP Blackrock.

Beware of Taxytis Symptom Obsession with Calculations

Beware of Taxytis Symptom Obsession with Calculations

Are you suffering from Taxytis- the annual struggle of making sound tax planning decisions for most Indians? Consider DSP BlackRock Tax Saver Fund to aim to deal with Taxytis effectively.

What are the benefits of investing in a mutual fund?

What are the benefits of investing in a mutual fund?

This video explains the benefits of investing in mutual funds and one of the major benefit is tax saving.

What are tax saving schemes?

What are tax saving schemes?

This video explains the meaning of Tax Saving Scheme.

Kotak Mutual Fund Tax Se Ho Jao Relax

Kotak Mutual Fund Tax Se Ho Jao Relax

Kotak Mutual Fund presents to you Kotak Tax Saver that helps you save tax and create wealth at the same time. Invest in the Kotak ELSS, now.

Fund Manager Interview Series Rohit Singhania on DSP BlackRock Tax Saver Fund

Fund Manager Interview Series Rohit Singhania on DSP BlackRock Tax Saver Fund

The DSP BlackRock Tax Saver Fund completes 10 glorious years. Watch the fund manager Rohit Singhania share his views on the Scheme’s current positioning and its exposure to different sectors.

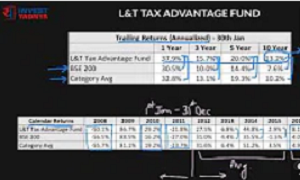

Mutual Fund Review L&T Tax Advantage Fund Top ELSS Mutual Funds 2018

Mutual Fund Review L&T Tax Advantage Fund Top ELSS Mutual Funds 2018

Aditya Birla Sun Life Tax Relief 96 is a popular in the ELSS category. It follows a multi-cap strategy. The fund has MNC stock bias. It was started in year 1996 and is one of the oldest and largest ELSS fund in the category. The Fund manager Anil Garg is managing the fund since 2006.

Save taxes with the help of ELSS #MarchToInvest

Save taxes with the help of ELSS #MarchToInvest

quity Linked Saving Scheme offers investors a tax deduction for an investment of up to Rs 1.5 lac which is allowed under Sec 80 C of Income tax Act 1961 (subject to a lock in period of 3 years).

How much tax can you save with ELSS?

How much tax can you save with ELSS?

Share less taxes and save more for yourself by investing in an ELSS (Equity Linked Savings Scheme).

Tax Saving Hack

Tax Saving Hack

We always try to keep our things to ourselves! Thankfully, you can now keep your income tax with you.

SBI Magnum Tax Gain Scheme Tax Saving Mutual Fund SBI Mutual Fund

SBI Magnum Tax Gain Scheme Tax Saving Mutual Fund SBI Mutual Fund

The prime objective of scheme is to deliver the benefit of investment in a portfolio of equity shares, while offering deduction on such investments made in the scheme under section 80C of the Income-tax Act, 1961. It also seeks to distribute income periodically depending on distributable surplus.

Don’t just save taxes, aim to create wealth too!

Don’t just save taxes, aim to create wealth too!

Mutual Fund not just provides you tax saving option but also wealth creation. It offers investors a tax deduction for an investment of upto Rs 1.5 lac which is allowed under Sec 80 C of Income tax Act 1961 (subject to a lock in period of 3 years).

Reliance Mutual Fund SimplySave

Reliance Mutual Fund SimplySave

This video is about Reliance Mutual Fund- Simply Save to choose your prefixed amount whenever you feel the impulse to save your money by downloading the Reliance mutual fund App.

How To Invest DSP Blackrock Tax Saver Mutual Fund? Step By Step Buy Sip Of Dsp ELSS Fund

How To Invest DSP Blackrock Tax Saver Mutual Fund? Step By Step Buy Sip Of Dsp ELSS Fund

DSB Blackrock Tax Saver Fund is conservative fund in the ELSS category with a Large cap focused portfolio. Its AUM has almost grown 2.5 times in last 1 year.Fund’s performance has been very consistent and is one a rare funds which have never performed both below benchmark and category avg in calendar returns. Though Fund’s performance during bear phase is very close to avg.

DSP BLACK ROCK TAX SAVER FUND ELSS VERY GOOD FUND FOR WORKING PROFESSIONAL

DSP BLACK ROCK TAX SAVER FUND ELSS VERY GOOD FUND FOR WORKING PROFESSIONAL

This video explains how the tax saver fund and ELSS from DSP BlackRock is beneficial for working professionals.

HDFC MF ELSS Film

HDFC MF ELSS Film

Here’s the smart way to save tax. By investing in ELSS, you gain a tax deduction (section 80C) on the amount that you invest in the fund. What’s more, you even benefit from capital appreciation.

Do you delay your tax planning

Do you delay your tax planning

This video shows the consequences of procrastination in tax planning. The more you delay your planning the less tax you can save. Watch this video for more information.

What are Tax Saving Mutual Funds SBI Mutual Fund

What are Tax Saving Mutual Funds SBI Mutual Fund

The prime objective of scheme is to deliver the benefit of investment in a portfolio of equity shares, while offering deduction on such investments made in the scheme under section 80C of the Income-tax Act, 1961. It also seeks to distribute income periodically depending on distributable surplus.

Which tax saving schemes do you invest in #AskWhatELSS

Which tax saving schemes do you invest in #AskWhatELSS

Most people invest to get tax benefits. So we asked people what are the various tax-saving instruments they invest in. The results are quite fascinating! #AskWhatELSS