Investing for children’s education, marriage, etc. occupy a prominent position in most people’s list of life goals. You have been saving and investing for these goals in order to ensure that your kid is not compromising because of lack of money and is getting prepared to lead a good quality of life. At the same time, you are also concerned about how your child will manage his finances, spend and save wisely, plan & work towards his financial goals independently.

Our children have not yet had any financial responsibility like paying for insurance, or managing family expenses, or paying for their own education, etc. Some parents try to inculcate the habit of savings in their children from early childhood but this is mostly limited to saving a rupee from their pocket money so that they can splurge their savings on crackers during Diwali, or because they will get a treat from their parents after they meet a goal of accumulating a certain sum of money.

Making your kids familiar with savings is important but the tricky part is introducing your growing children to reality, explaining investments and instilling the interest in them to learn about financial planning. Before explaining the concept of investing to your kids, you must brush up your basics so that you are able to communicate vital information clearly.

Following are a few key points which can help you in teaching your child the basics of investing and the importance of financial independence.

Start at the right age: Don’t talk about investment jargons with your kid while he’s struggling with his nursery rhymes. Wait until he is able to think relatively and comprehend the implications of simple and compound interest, percentages, profit and loss, etc. Talking too early will result in nothing but overhead transmission and create confusion in the mind of your child. Generally, a child is able to attain the maturity of thinking mathematically when he enters adolescent stage, yet it varies from one child to another.

Introduce the basics: Start with explaining the basic concepts, viz assets and liabilities. You can narrate the meaning and importance with the help of real examples like the house you live in is your asset and the loan on the house for which you pay monthly EMIs is your liability. Tell the meaning and importance of investing and various types of investments like stocks, bonds, mutual funds, etc., and how these investments can help in building assets and can enable you lead a happy and comfortable life.

Involve your kids: Discuss your family finances with your kids. They should have an idea about your income, assets, the debt you owe to others, how you manage your monthly expenses, budget, etc. Live events can help him understand investing better, like how the car got financed, how a medical emergency was met with the insurance policy you have, or how the vacation you went for was met with the Mutual Fund SIP. He/she should understand that happiness can be achieved by investing. You can also gain your child’s attention by playing money games like business, risk, etc., as well as through mobile apps. Once he gets excited & involved in the games, he’ll be able to relate it better when it comes to reality.

Meeting with your financial advisor: When you meet your financial advisor, you can ask your kids to sit with you in the meeting. They would get to know about goals and portfolio allocation, financial planning, etc. Even if they do not understand the details, it would give them a fair idea about investing. Further, you are there to guide them and answer their queries.

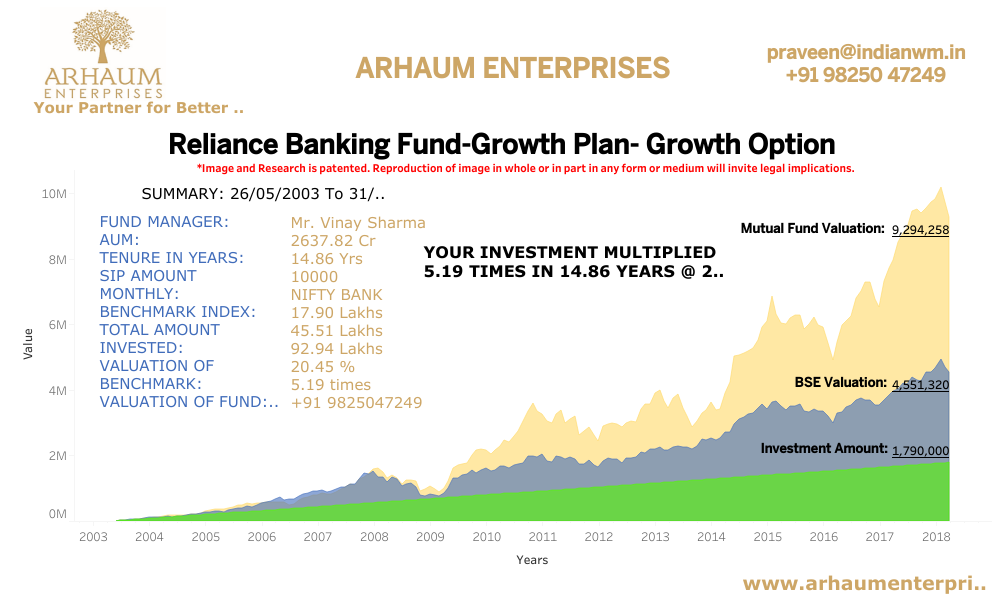

Invest their savings: Another way to expose your kids to investing is investing their small savings. Invest their money in a good investment product, and help them track its growth over time. You can also build a mock portfolio for them and let them track the profits and losses. Let them gauge the losses that can occur due to quick decisions and the benefits of patience & long term investing. They may not be gaining or loosing big money, but the excitement of profits and losses will help them comprehend investing.

Remember, there should not be information overload at any given point of time. You must break the information into smaller and simpler parts. Try to explain with the help of examples and the impact that investments have on our lives. Try to inculcate the habit of saving in your kids from the very beginning. They should know about the gains that they can achieve through investing as well as the basic, “investing for the long term will help in achieving the gains”.