Most of us want to reduce the tax outgo on our salary as much as possible. For this purpose, the investment limit of Rs 1.5 lakh a year, allowed as deduction from your income under Section 80C of the Income Tax Act, can play a large role. But that also means that a chunk of your annual savings has to be invested in these options, leaving very little surplus for other investments to build wealth. That essentially means that you have to invest smartly when you invest to save tax. That is, save tax and build wealth at the same time. But do you do that?

You can do this by diversifying your tax-saving investment basket and ensuring you have contemporary market-linked products that deliver superior returns in the long term. Under Section 80C, the typical investment plans for saving on taxes include your Employee’s Provident Fund, Public Provident Fund (PPF), the NSC, the five-year tax-saving deposit and tax-saving mutual funds. Then there are the pure insurance covers and investment-linked insurance plans such as ULIPs.

While the traditional options have their own advantage, tax-saving funds score over the other options on various counts. Before we move to the advantages, what exactly are these funds? They are simply diversified equity funds that invest in stock markets and additionally provide a tax deduction on the principal amount you invest, in the year of investment.

That means they are not different from an equity fund in terms of their investing objective or strategies they can adopt. Here’s how this class of tax-saving instrument scores over the other options:

Tax-saving funds have the shortest lock-in period (3 years), when compared with other options. That means post the 3 years, while you can stay invested, you will have the leeway to take out the money when you need it.

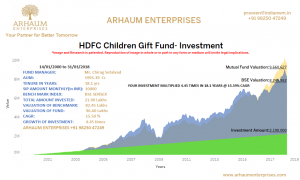

Tax-saving funds, being linked to equity markets, have proven to be superior returning options over the long term. Tax-saving funds have on an average delivered about 20% annualised returns in the last 3 years (category average returns as of October 7,2015). Of course, while they are also subjectto market vagaries, over the long term, their returns have proven to be far superior to traditional options such as PPF or NSC. PPF interest rates, for instance, have fallen from 12% in 1999 to 8.7% now. Clearly, fixed return products have seen a decline in rates promised, over the years.

Unlike options such as 5-year tax-saving bank deposit, where the interest income is entirely taxable, tax-saving funds, being equity funds, enjoy tax exemption on the long-term capital gain. That means the entire gain is free of tax. That means they enjoy dual tax advantage. One you enjoy deduction on the principal at the time of investment and then enjoy exemption on the entire gains at the time of sale.

Besides, the above advantages, tax-saving fund, like any other mutual fund, is highly transparent, with daily NAV declaration, monthly portfolio and factsheets and so on. Thus, you can always keep an eye on your investment.

Best ways to invest

It makes sense to start investing in tax-saving funds, early partof the year, through SIPs.

This way, you can average your costs in the equity market and also spread your investments lest you do not have sufficient surplus to invest. If you truly wish to average across market phases, continue SIPs for 3 to 5 years and claim every year the way you would do with your insurance premium or other regular tax-saving options.

Added to this, link some of your key medium to long-term goals such as saving for children’s education or your own retirement to these investments. That would help you save tax and build wealth