Financial advisors may ask investors to have modest return expectations from equities, at 12 to 15 per cent. But the secret desire of most retail investors is to unearth multi-bagger stocks that can mint millions. This dream is often fuelled by stories from their friends and family about obscure stocks that turned out to be diamonds in the rough.

Get updates from Value Research in your inbox

Stocks versus mutual funds

There are certainly many small-cap stocks in the Indian market that boast rags-to-riches stories in the last 10 years. Take the case of Ajanta Pharma, a small-sized pharma company focused on domestic sales, which featured a mere Rs 100 crore market cap in March 2008. It has seen its stock price zoom from Rs 12 to Rs 1,398 in 10 years. (All stock price data in this story are adjusted for bonus/splits and capture returns from March 2008 to March 2018). Or take the crockery maker La Opala RG, which starting out at a mere Rs 32 crore market cap, has seen its stocks soar from Rs 33 to Rs 3,589.

Then there are those success stories of companies that have graduated from small-cap to large-cap status by rapidly scaling up their business. Eicher Motors, originally a truck company, acquired the Royal Enfield brand to become a go-to brand for upmarket motorcycles. It has seen its adjusted stock price zoom from Rs 277 to Rs 27,740 a 100-fold gain in 10 years. This has taken its market-cap up from about Rs 800 crore to Rs 75,000 crore. Or there is Bajaj Finance, which has grown from the captive financing arm of Bajaj Auto to a consumer financing giant in just about 10 years. Its stock price has soared from Rs 39 to Rs 1,659 and market cap from about Rs 1,400 crore to nearly Rs 1 lakh crore.

On a CAGR basis, the top small-cap stars have managed a CAGR of anywhere between 40 and 60 per cent over the last 10 years. Investors measuring small-cap equity mutual funds against these stocks may be dissatisfied. Over a similar 10-year window, leading small-cap equity funds have managed an 18 to 20 per cent CAGR.

But while it is such comparisons that have retail investors dabbling directly in small caps, the above stock examples suffer seriously from hindsight bias. In real life, retail investors looking to take the do-it-yourself route to small-cap investing have to surmount three big hurdles to create long-term wealth.

Selecting the survivors

Searching for quality small-cap stocks in the Indian market is like looking for a needle in haystack because there are literally hundreds of sub-par stocks littering up the listed space. To arrive at the odds of an investor latching onto a multi-bagger small-cap, Value Research ran a screener on all NSE-listed stocks that featured a market cap of Rs 2,000 crore or less exactly 10 years ago, in March 2008 and calculated their CAGR returns on their adjusted stock price (for bonuses and splits).

Of the 715 stocks on our list in March 2008, as many as 224 delivered losses to investors after a10-year holding period to March 2018. That’s a 31 per cent chance of picking a lemon and losing money on a small-cap despite a 10-year wait. These loss-makers included some names that really decimated investor wealth. There’s pipe maker PSL, which nosedived from Rs 355 to Rs 4 in 10 years; power-equipment firm Bilpower, which tumbled from Rs 100 to Rs 2; Subex, a software company, which saw its stock price fall from Rs 258 to Rs 9. In fact, there were 29 stocks in the list that wiped out at least half of their investor’s capital in the last 10 years.

Therefore, while it may appear to be quite an easy task to explain why Eicher Motors or Bajaj Finance have turned out multi-baggers, it would have been very difficult indeed to take this call in March 2008, when Eicher or Bajaj were one among a thousand stock choices that one could have made.

If you go wrong, the chances of a small-cap company not surviving a decade are quite high because scaling up from a tiny to a mid-sized firm in any industry is far more challenging than scaling up from a mid-sized firm to a large one.

Scaling problems

For a small-sized firm to turn into a multi-bagger, it isn’t just enough for the company to survive. It has to thrive and deliver faster growth than all its peers in the industry. Most small-cap firms stumble at this task. Of the 715 small-caps we started out with in 2008, 383 stocks or 54 per cent, did not manage even a 10 per cent CAGR in their stock over the next 10 years. In fact, only a third of the small caps on the list managed the minimum investor expectation of a 15 per cent CAGR.

It is also hard to estimate when a small-cap may turn the corner. When a small company you own stays at a midget size for many years, it is natural to get frustrated and exit the stock. Often, you find the business suddenly picking up and delivering just after you exited it!

Stocks that turned out to be multi-baggers or managed bumper CAGRs of over 26 per cent per annum numbered 109. Basically, for every 100 small-caps that were traded on the NSE in March 2008, only 14 turned out to be the kind of multi-baggers that investors love to own.

Picking winners isn’t quite as easy as a monkey throwing darts because you find no common sectoral or macro ‘theme’ to those 10-year winners. The top five wealth creators over a decade feature a pharma firm (Ajanta Pharma), a crockery maker (La Opala RG), an agrochemicals company (Bharat Rasayan), a pressure-cooker maker (TTK Prestige) and a sanitaryware maker (Cera Sanitaryware), all of which would have been difficult to identify as scalable opportunities 10 years ago.

Hanging on

Ask any HNI owning small-cap stocks or professional fund manager and they will tell you that biggest challenge in making money from small-caps lies not in buying them but in hanging onto them.

Though looking at the CAGR returns on small-caps can give the impression of a steadily soaring price graph, real-life returns on these stocks came in a very ad-hoc fashion over the years, where the stock would do nothing for a long time and then rise by leaps and bounds. For instance, Avanti Feeds, now a mid-cap, managed barely any returns for a three-year period from 2008 to 2011. Relaxo Footwear, now a crowd favourite, fell steeply from Rs 560 to Rs 360 between July 2015 and March 2016. Only investors who were brave enough and confident enough to hold during this fall would have experienced its next high at over Rs 670.

Enjoying their multi-bagger returns at the end of 10 or 20 years, therefore, means holding onto these stocks through turbulent times as well as times when the stock or business does absolutely nothing. It also means not booking profits too early because you are afraid of losing money.

Finally, because they aren’t tracked by an army of analysts, small-cap stocks are far more prone to governance risks than mid-caps or large-caps.

Mutual fund route

To cut a long story short, yes, DIY investing in small-caps can be immensely rewarding for you if you are skilled, lucky and patient enough to buy and hold the right stocks. But the costs of going wrong are extremely high and you should be willing to watch over your portfolio like a mother hen. Most investors who have a full-time job or profession to pursue will find it difficult to do this on their own.

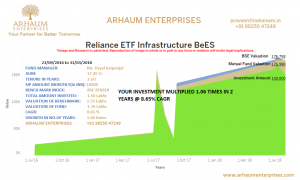

This is why mutual funds specialising in small-cap or micro-cap stocks may be a better choice for retail investors who would like to reap riches in this space. Given that there are only four or five small-cap equity funds with a long-term track record, choosing the right small-cap fund and hanging on is far easier than navigating the minefield of DIY investing. The pay-offs may be lower, but the probability of making a good return is many times higher than direct investing.

Below, you will find the links to our interviews with the fund managers of the small-cap funds we have recommended.