For those who may choose to not see the lights may be left searching for answers. So let us bathe ourselves on in light of these priceless words said by the masters. To keep things simple, we are only listing the most important ones for our readers.

Investor behaviour has been a subject of deep study with many authors and finance experts reflecting their opinions on it. As is most commonly seen, investor behaviour often deviates from rational and reason. The individual personality traits matter a lot while decision making, often complicating them. The personality is subject to influences, ego and emotions like impatience, fear, greed and hope.

These factors often cloud the facts for decisions which end up being judgmental and biased resulting into wrong decisions. This famous statement by Graham rightly highlights this point.

There is another way at looking at this. As smart investors, we should look to allocated most money to the best ideas or assets that have potential to deliver the highest. At the same time, we should also ensure that our mistakes are not so costly that they harm our wealth noticeably. It is also a pointer to how most of us view and manage our portfolio which are often heavily skewed in favour of fixed income /debt products /physical assets, etc. even though our risk profile may permit a far more balanced asset allocation.

Most of us have a small exposure to equities when we consider our total portfolio but still are most worried about it on a daily basis. Given this mindset, in the context of the quote, we must question ourselves: what are the “costs” and “profits” of what we are doing with our overall portfolio? We should stop worrying about a small portion of our wealth in say equities and instead look at the big picture. Let us focus on diluting those debt products for short term needs and lets give adequate time to equities to give compounded returns in long term. The sooner we reflect upon George’s wisdom in our lives, the better will it be for our own wealth creation goal.

Warren had the skill of telling the most important things in the most simple way.  This quote and many others similar, shows Warren’s belief that that wealth creation was not a forte for the intelligent but for the disciplined. Anyone of us can be wealthy in our lives and it can be done provided we do few important things in our lives and not do the wrong things. This is clearly in reference to how investors approach their wealth /portfolio management wherein we try to time the markets not realising that it is staying invested for long term that really helps create wealth. If we add all the costs of all the wrong decisions, market timings, etc. done in past by us, put together, they would most likely amount to lots of lost wealth.

This quote and many others similar, shows Warren’s belief that that wealth creation was not a forte for the intelligent but for the disciplined. Anyone of us can be wealthy in our lives and it can be done provided we do few important things in our lives and not do the wrong things. This is clearly in reference to how investors approach their wealth /portfolio management wherein we try to time the markets not realising that it is staying invested for long term that really helps create wealth. If we add all the costs of all the wrong decisions, market timings, etc. done in past by us, put together, they would most likely amount to lots of lost wealth.

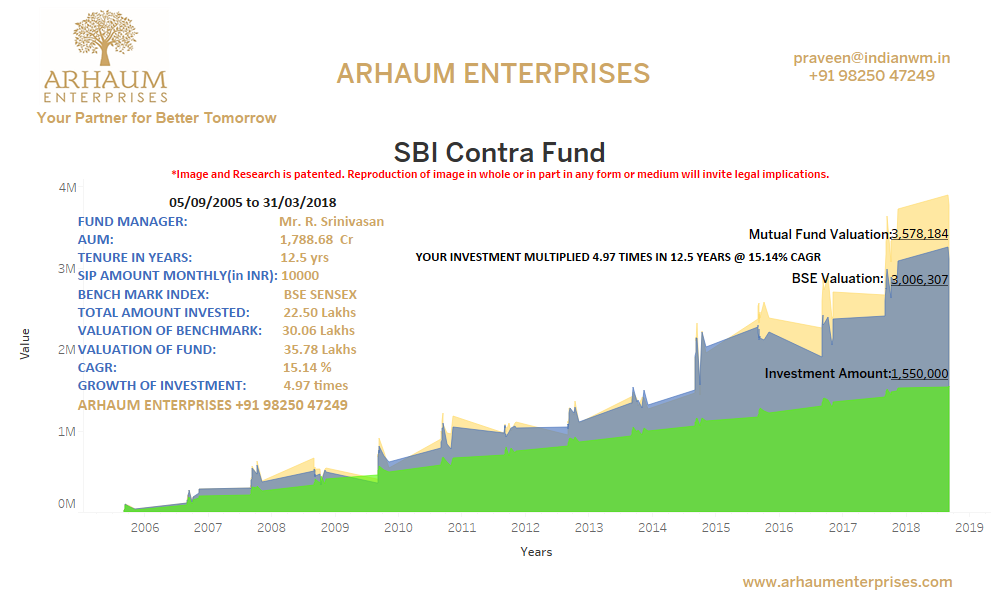

The important principles of starting early, investing regularly and right asset class (‘equities’) ought to be highlighted here. These are the right things that we all should aim for. We need not be scientists or finance experts or even literate to follow these principles to be truly wealthy.

Much success can be attributed to inactivity. Most investors cannot resist the temptation to constantly buy and sell.

– Warren Buffet

You won’t mind us quoting Warren here again. It is probably one of the greatest mysterious wherein on one hand almost all investors idolise Warren but on the other hand, most of us do not truly follow his wisdom and advice. One of the most often quoted advice /wisdom from Warren is about how we can really create wealth in long term. It is about buying into good businesses and holding them for a very long term without worrying about what happens tomorrow. The above quote clearly reflects how most of us are often worried about short term movements while the true need of the hour is to keep invested for the long term and being passive. Investors have to believe that, if they are investing for long term for say 7-10+ years, short term movements do not really matter. “Stop trying to predict the direction of the stock market, the economy or elections” he says while attributing patience and long term holdings as among the most important factors behind his success.

In brief..

Keeping in mind the spirit of this article, we have only given only four essential quotes though we could have easily added a few more. The idea was to keep the focus on the essential part and not flirt with other less important things. The wisdom from the above quotes focusses on the key essentials – managing investor behaviour, looking at the bigger picture, doing the right things and then having patience to let investments deliver. Out together, these ideas take form as the basic principles, a guiding light on path to becoming rich. And there is really nothing more that we should add to it.