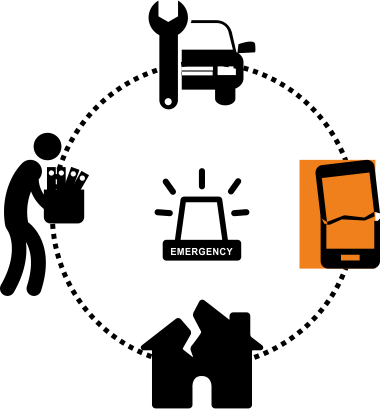

EMERGENCIES DON’T KNOCK THE DOOR

Did ever emergencies tell you that they will be coming? No. Hence they never give you time to get prepared unlike other goals such as kids higher education or their weddings or your retirement etc. Emergencies can be as small as a loss/damage of your smart phone or as big as a temporary loss of income due to major illness or other mishaps. No matter how small or big they are, they can derail your finances and bring discomfort to your lives.

Expect The Unexpected & Be Prepared!!

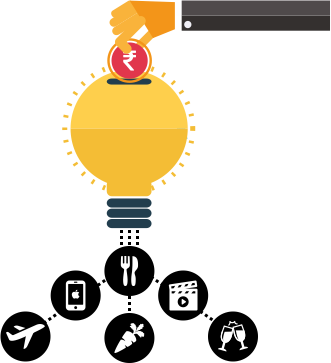

SAVING ACCOUNT IS NOT AN EMERGENCY FUND

Is your savings account your Emergency Fund too? If that is the case then there are chances that you may not be able to meet your day-to-day needs in times of emergencies. Savings account is that one stop solution which fulfills all your needs and can fulfill all your wants. Hence it’s difficult to control the urge of leaving that exotic vacation or that latest smart phone or that weekend party etc. just for fighting with those unforeseen emergencies that may or may not come.

What if emergencies hit you when you don’t have enough money in account!!If you just track down how much you have been spending on these things, you would be shocked to see that they consume a major chunk of your income without even letting you know.

Watch out for the little things you spend on And see whether they are worth it!!

DON’T DIP INTO OTHER GOALS SAVINGS

Financial Assets offer the ease to withdraw at will. This often turns out as the biggest disadvantage when all financial assets are treated as money in hand. Emergencies create worrisome situations and leave us in despair. To combat such times we tend to dip into the savings done for other goals. If you will do it once, you will do it again and again whenever you need money.

Is it right to cater to present needs at the cost of future needs!!

ITS TIME FOR AN EMERGENCY BUCKET